On January 3, 2026, the United States launched Operation Absolute Resolve, a military intervention in Venezuela that captured President Nicolás Maduro and his wife Cilia Flores. It was the most significant US military action in Latin America since the 1989 Panama invasion.

The conventional playbook for geopolitical shocks says markets should have panicked. Risk assets sell off, investors flee to safety, and crypto gets caught in the crossfire. That's not what happened.

Bitcoin dipped about 3% to $89,000 in the hours after the strike. By Monday, it had recovered to $93,000. As of January 16, BTC sits around $95,500, up 6% since the intervention, outpacing both gold (+1%) and the S&P 500 (+1.2%) over the same period. The dollar index, which typically rallies during geopolitical crises, actually fell from its mid-December peak to around 98.57.

This wasn't supposed to happen. So what's going on?

The Framework: What Actually Moves Crypto

Geopolitical events only matter for crypto insofar as they change four things: USD strength, interest rates, risk appetite, and liquidity. If an event doesn't materially alter any of these transmission mechanisms, the market reaction will be muted, regardless of how dramatic the headlines are.

The Venezuela intervention doesn't move the needle on any of them. Here's why.

Not All Conflicts Are Created Equal

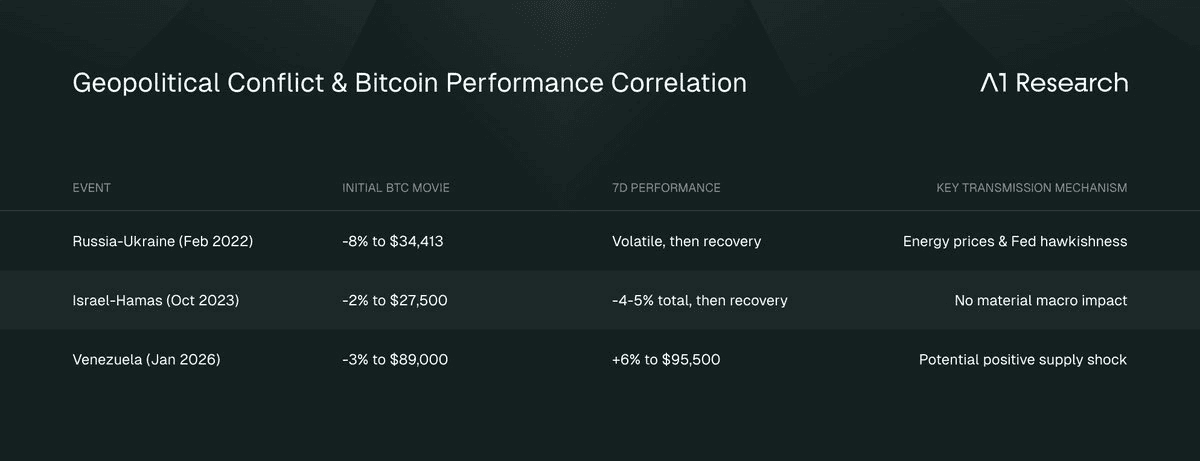

To understand Venezuela, compare it to two recent precedents.

Russia-Ukraine (February 2022)

Bitcoin plunged 8% within hours, crashing to $34,413. Over $150 billion was wiped from the crypto market in 24 hours. The subsequent bear market lasted through 2023, though it was driven as much by macro factors (Fed rate hikes, the Terra/LUNA collapse, FTX implosion) as by the war itself.

Israel-Hamas (October 2023)

Bitcoin dropped about 2% initially to around $27,500, with the total correction reaching roughly 4-5% over the following days as it briefly fell below $27,000, before recovering. The market was largely resilient, and the attack coincided with the start of the 2023-2025 bull run, though the primary drivers of that rally were ETF approval expectations and Fed pivot signals.

Venezuela (January 2026)

A brief 3% dip, immediate recovery, and a 6% rally over the following two weeks.

The pattern is clear, but the mechanism isn't obvious. Why did Russia-Ukraine devastate markets while Venezuela barely registered?

Four key differences:

Global financial integration. Russia was deeply embedded in the global financial system: SWIFT access, energy supply to Europe, commodity exports touching every corner of the economy. Venezuela is already isolated. It's been under US sanctions for years, accounts for less than 1% of US crude imports, and has minimal trade ties with Western economies.

Commodity disruption. Russia-Ukraine threatened 30% of global wheat supply, significant natural gas flows to Europe, and roughly 10% of global oil production. Venezuela's oil output averages around one million barrels per day, just 1% of global supply. During past crises, Venezuela accounted for over 7% of global production. Not anymore.

Sanctions shock vs. regime change. The Russia invasion triggered an unprecedented sanctions war that disrupted global financial plumbing. The Venezuela intervention doesn't create new sanctions. If anything, it removes them.

Duration uncertainty. Russia-Ukraine looked like a prolonged conflict from day one. Venezuela was a surgical operation completed in hours. Vice President Delcy Rodríguez has already signaled cooperation with the transition.

Walking Through the Transmission Mechanisms

USD Strength

The obvious argument is that US control of Venezuela's oil reserves (the world's largest at 303 billion barrels) would boost petrodollar demand. But at current production levels, Venezuela accounts for just 1% of global oil supply. The petrodollar impact is negligible.

A more plausible concern would be flight-to-safety flows into the dollar if the conflict escalated into US-China tensions. Venezuela is a strategic partner of China and Russia. But while the Chinese foreign ministry called for Maduro's release and condemned the intervention, neither Beijing nor Moscow has taken any material action. Verbal protest without consequences suggests they've accepted the fait accompli.

The dollar actually weakened after the strike. DXY fell from its mid-December highs to around 98.57. Markets aren't pricing in escalation risk. Multiple factors point to continued dollar weakness in 2026: expected rate cuts, a lower neutral rate under new Fed leadership, rising term premiums from fiscal stress, and more supportive balance sheet management.

The Venezuela intervention isn't strengthening the dollar because it's not creating a flight-to-safety scenario.

Impact on crypto: Neutral to slightly positive (weaker dollar supports BTC)

Interest Rates

If Venezuelan oil production eventually increases, it could add supply to global markets and put downward pressure on oil prices. Lower oil prices mean lower inflation, which gives the Fed more room to cut rates.

The catch: Venezuela's oil is heavy crude requiring specialized refinery capacity. PDVSA, the state oil company, estimates that $58 billion in infrastructure investment would be needed just to restore production to historical peak levels. The pipeline network hasn't been meaningfully updated in 50 years. Any supply increase is years away.

Current Fed expectations reflect this neutral assessment. Bond markets are pricing in about 50 basis points of cuts in 2026, with Morgan Stanley projecting one cut in June and another in September. The intervention hasn't shifted these expectations.

Impact on crypto: Neutral short-term, potentially positive long-term (if Venezuelan supply eventually materializes and keeps inflation contained)

Risk Appetite

For now, markets see no escalation risk. Risk assets have performed well since January 3. The S&P 500 rose 0.64% on January 6, the first trading day after the strike, with the Dow hitting a record high.

The critical question is whether this tests Bitcoin's "digital gold" narrative. If geopolitical tensions had escalated, would BTC have acted as a safe haven or sold off with other risk assets?

We didn't get to find out. The surgical nature of the operation meant markets never had to price in prolonged uncertainty. But it's worth noting that Bitcoin's market structure has fundamentally changed since 2022. The BTC-S&P 500 correlation rose to around 0.5 after the spot ETF approvals, while maintaining negative correlation with the dollar index.

Bitcoin now behaves less like digital gold and more like a macro asset that responds to institutional flows and Fed expectations.

ETF inflows and corporate treasury purchases (including a $1.25 billion BTC acquisition) pushed Bitcoin above $97,000 earlier in January. This institutional infrastructure means BTC now has a different holder base with different time horizons and rebalancing behaviors than the retail-dominated market of 2022.

Impact on crypto: Neutral (no escalation means no test of risk appetite)

Liquidity

The Trump administration has stated that US oil companies will invest billions of dollars in Venezuelan infrastructure. This represents potential capital deployment that could eventually flow into risk assets.

However, this is a multi-year project. The IEA projects a global oil market surplus through 2026 regardless of Venezuela. Near-term liquidity impact is negligible.

The more interesting angle: markets are pricing Venezuelan production increases as a positive supply shock, not a disruption. Oil prices rose just 1% in the days following the strike.

The reaction suggests traders see more supply coming online eventually, which is deflationary, not inflationary.

Impact on crypto: Neutral short-term, potentially positive long-term

The Bottom Line

The Venezuela intervention was a non-event for crypto because it doesn't change any of the macro fundamentals that actually drive prices. USD strength, interest rates, risk appetite, and liquidity are all essentially unchanged.

This isn't a failure of markets to price geopolitical risk. It's markets correctly identifying that this particular geopolitical event doesn't create the kind of systemic disruption that moves asset prices. Venezuela isn't Russia.

A surgical regime change isn't a grinding war of attrition. Isolated economies don't produce global spillovers.

What Would Change the Analysis

Several scenarios could shift this assessment:

Iranian escalation

US-Iran tensions are already elevated. If the Venezuela intervention emboldens further action in the Middle East, that changes the calculus entirely.

Chinese economic retaliation

Unlikely given the muted response so far, but targeted trade measures or currency intervention would have real effects.

Prolonged Venezuelan instability

If the transition government fails and the country descends into chaos, regional contagion becomes a concern.

Dollar safe-haven flows

Any of the above scenarios could trigger the flight-to-safety dynamic that didn't materialize this time.

For now, the base case remains: geopolitical theater without macro substance. Markets got this one right.

Recommended Articles

Dive into 'Narratives' that will be important in the next year