General

Jan 15, 2026

11 min read

by

Look, 2025 was weird. Really weird.

This was supposed to be the year crypto finally "made it" and in some ways, it did. We got institutional adoption, some regulatory clarity, ETF expansion, the whole nine yards. But if you were retail? If you were degening into altcoins or riding the memecoin wave? Yeah, you probably got wrecked.

This article briefly will walk you through what actually happened mostly using visuals and data.

Executive Summary

2025 marked crypto’s shift from speculative excess to institutional normalization, driven by U.S. regulatory clarity, ETF expansion, and stablecoin legislation, while retail participants faced drawdowns and capitulation.

October 10 became the regime break for the market, as the post-ATH liquidation cascade wiped out leveraged positions and permanently damaged risk appetite for the rest of the year.

Institutional conviction remained intact despite falling prices, with continued ETF activity, net-positive DAT inflows, stablecoin growth, and rising RWA adoption.

Bitcoin solidified its role as an institutional and sovereign-grade asset, supported by strategic reserves and treasury-style accumulation, even after a deep drawdown and negative YTD performance.

Market breadth collapsed, with most altcoins, TGEs, and speculative narratives underperforming, signaling the end of liquidity-driven “everything goes up” cycles.

Stablecoins emerged as core financial infrastructure, growing supply by ~47% and decoupling from risk-asset volatility through payments, RWAs, and yield use cases.

Real adoption progressed quietly while hype-driven sectors failed, as RWAs and DATs expanded, AI agents reset before rebuilding on real infrastructure, and memecoins rapidly unwound.

Security remained the industry’s weakest link, with repeated exploits and operational failures highlighting gaps in protocol design, custody, and risk isolation.

The year ended with a sharp institutional–retail split, positioning crypto as a permanent asset class while retail sentiment reached extreme pessimism.

The year ended with a sharp split: institutions on one side treating crypto as a permanent asset class, retail on the other side at extreme pessimism levels.

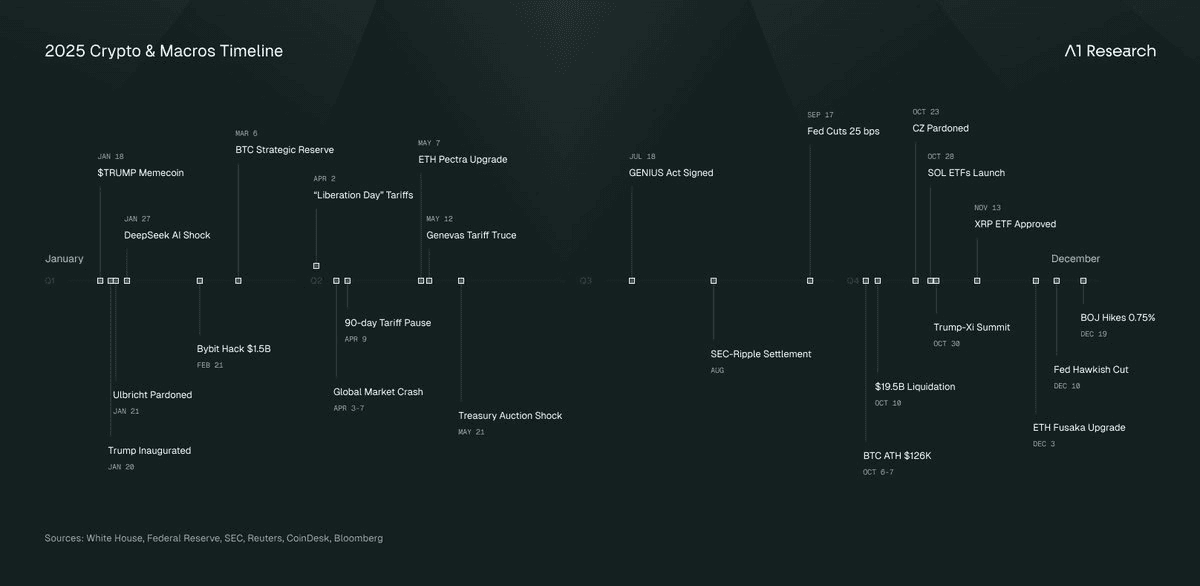

The 2025 Timeline: When Macro Took Control

2025 was a year where macro, geopolitics, and policy dominated crypto price action.

From Trump’s inauguration and tariff shocks, to BOJ rate hikes unwinding the yen carry trade, to direct geopolitical conflicts reshaping risk premiums crypto traded as a global risk-sensitive asset early, and as a geopolitical hedge later.

We tried to show all the major events through our timeline graphic down here.

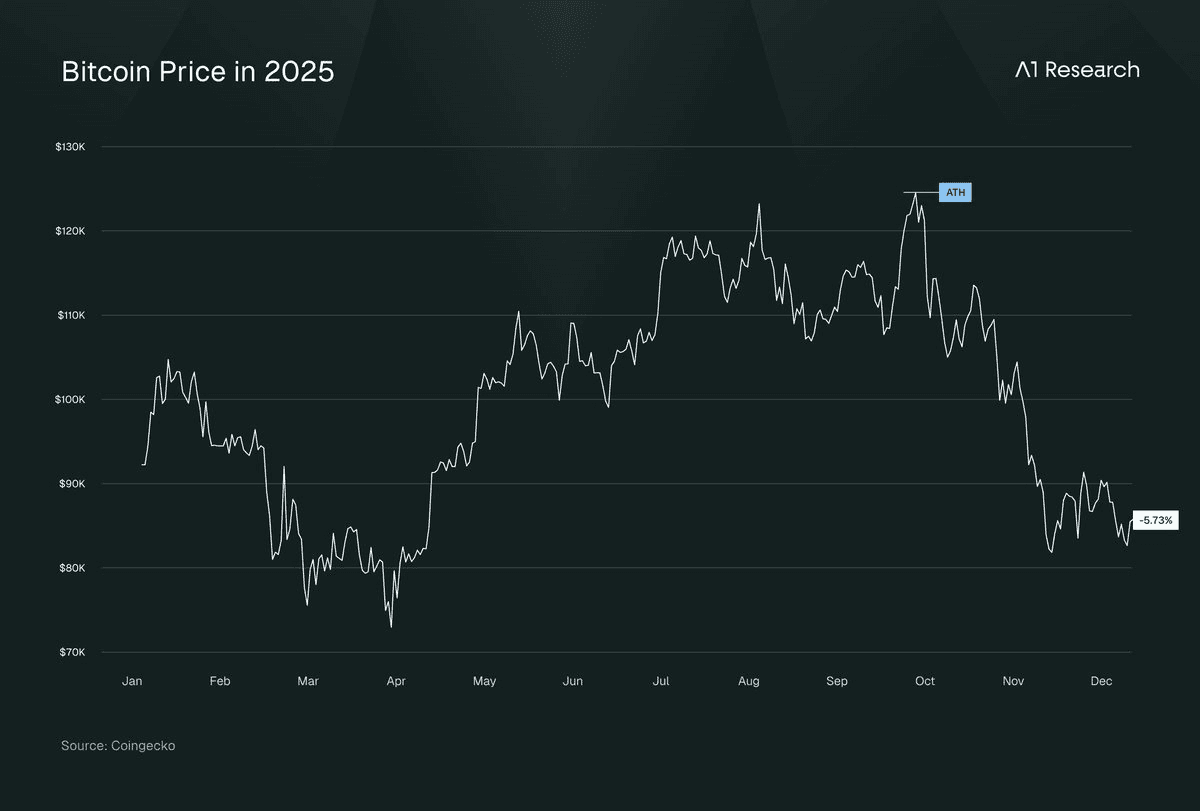

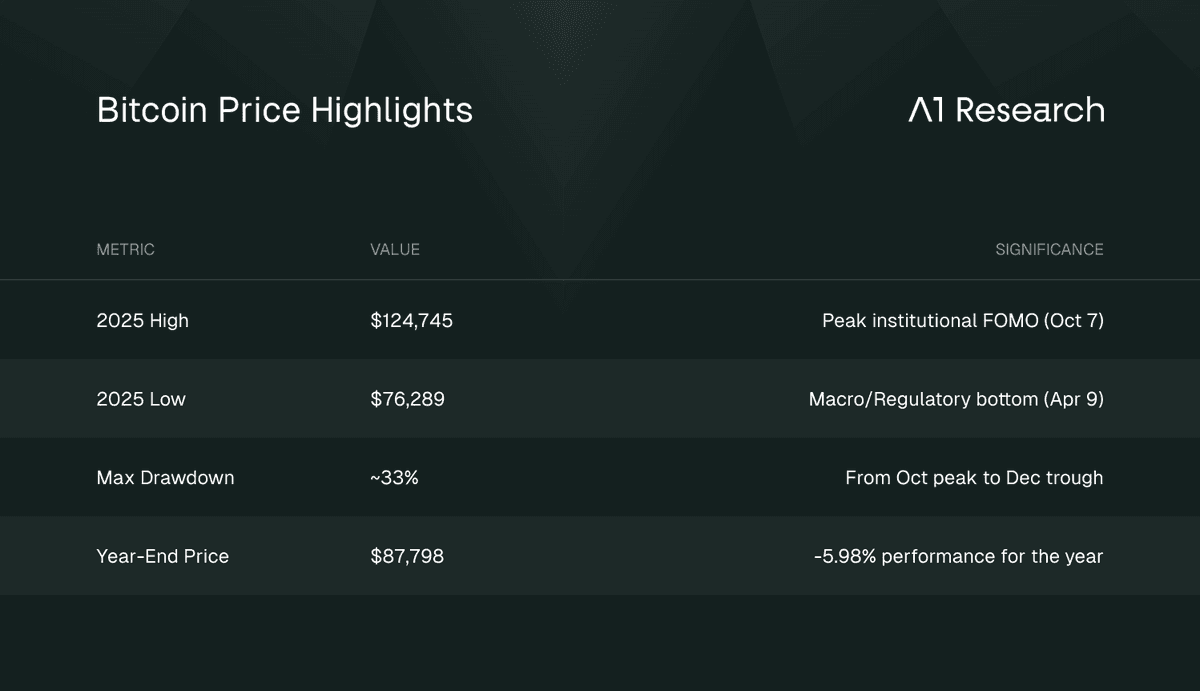

What about Bitcoin?

Bitcoin's 2025 price action perfectly encapsulated the year's macro-driven narrative. The asset entered January trading above $90K but quickly succumbed to the tariff-induced risk-off environment, bottoming at $76,289 in early April as Liberation Day fears and regulatory uncertainty peaked.

What followed was a relentless grind higher as institutional flows accelerated by ETF inflows, sovereign interest, and the GENIUS Act's passage created a perfect storm of demand. Bitcoin printed its all-time high of $124,745 on October 7th, coinciding with peak institutional FOMO.

However, the final quarter reminded markets that crypto remains a high-beta asset: a 33% drawdown from the October peak, driven by Fed hawkishness and year-end de-risking, left Bitcoin at $87,798, technically red for the year at -5.98%. It was truly a uniquely bipolar trading environment throughout 2025.

What About the Rest of the Crypto Market?

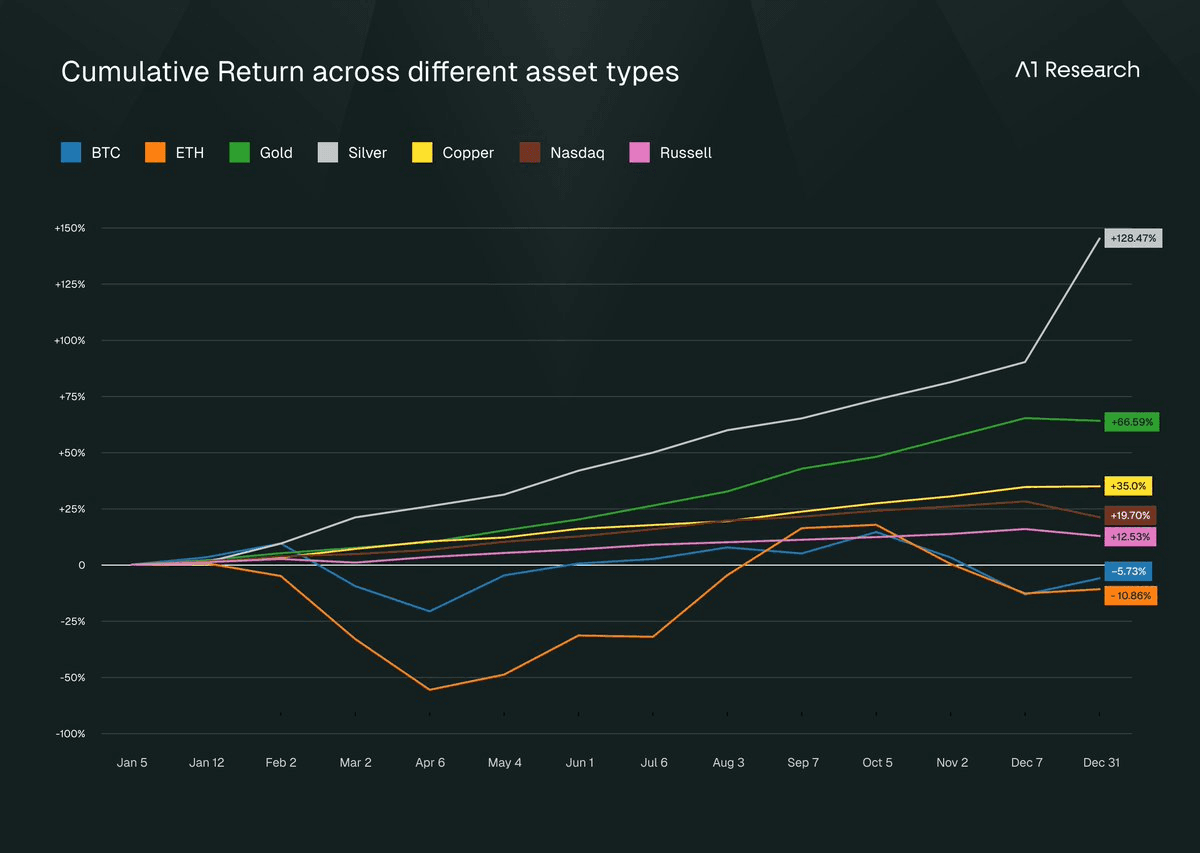

No sugarcoating this one. Crypto was objectively the worst performing asset class in 2025.

Silver and gold? They crushed it. Traditional markets? Did fine. Bitcoin and altcoins? Net negative across the board.

The institutional money came in, sure. But price-wise? It was a bloodbath for anyone who bought near the highs.

But let's dive deeper.

October 10: The Day Everything Broke

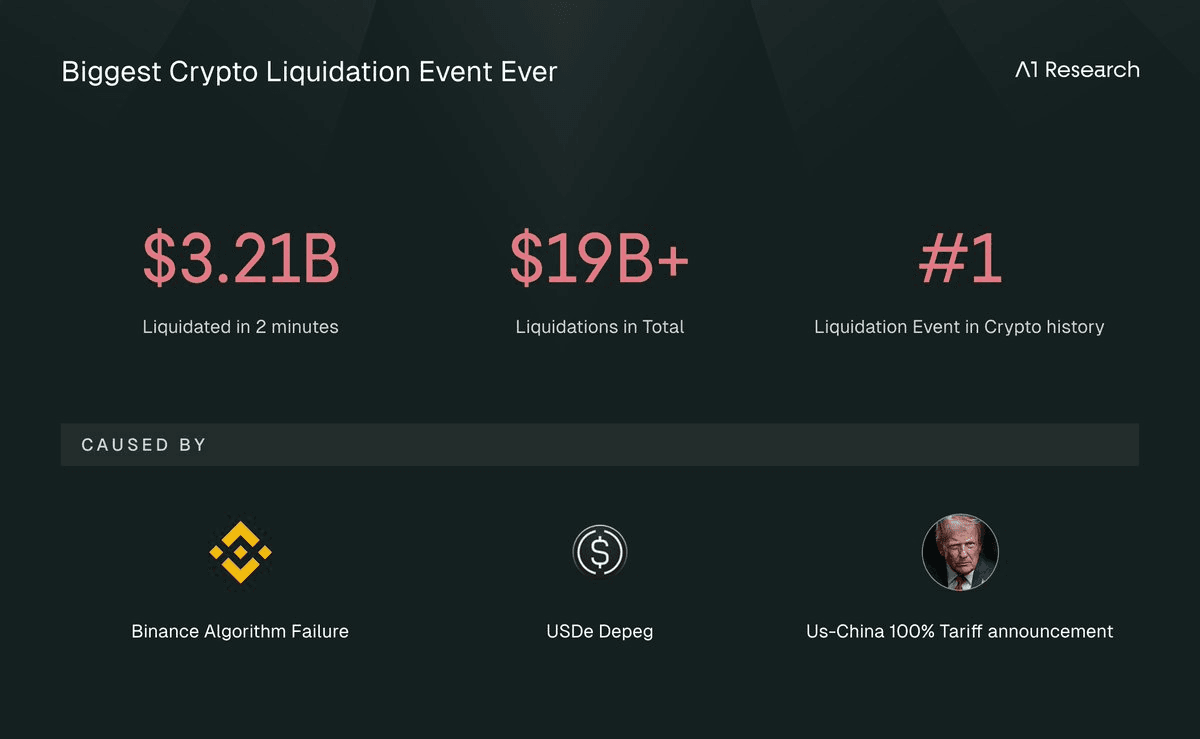

If you were in crypto on October 10, you'll never forget it. This wasn't just another dip. This was a complete system failure that wiped out $19 billion in what felt like seconds.

What happened?

The Macro Trigger: Trump announced 100% tariffs on China. Risk-off sentiment immediately cascaded through global markets. The S&P 500 lost $1.2 trillion in 40 minutes. Crypto, trading 24/7 with no circuit breakers, reacted the hardest.

Binance's Oracle Flaw Gets Exploited: Binance's Unified Account system had a known vulnerability – it priced collateral (USDe, wBETH, bnSOL) using internal order book data instead of external oracles. The fix was scheduled for October 14. Oops.

USDe Depegged to $0.65 (only on Binance): Someone coordinated a dump of $60-90M worth of USDe, crashing its price to around $0.65 on Binance while it held at $1 everywhere else. Collateral values for thousands of margin accounts instantly collapsed.

The Liquidation Cascade Triggers: Margin systems marked down collateral values. Forced liquidations started. That selling pressure pushed prices lower. More liquidations triggered. At peak intensity, $3.21 billion got wiped in 60 seconds.

Liquidity Completely Evaporates: Order book depth collapsed by over 90%. Spreads widened to 22%. Market makers pulled out. There was literally no bid-side support. The feedback loop just kept accelerating.

This event permanently changed market psychology. Risk appetite never really recovered. October 10 became the regime break that divided the year into "before" and "after."

But here's what's interesting: while retail got wiped out, institutions didn't flinch.

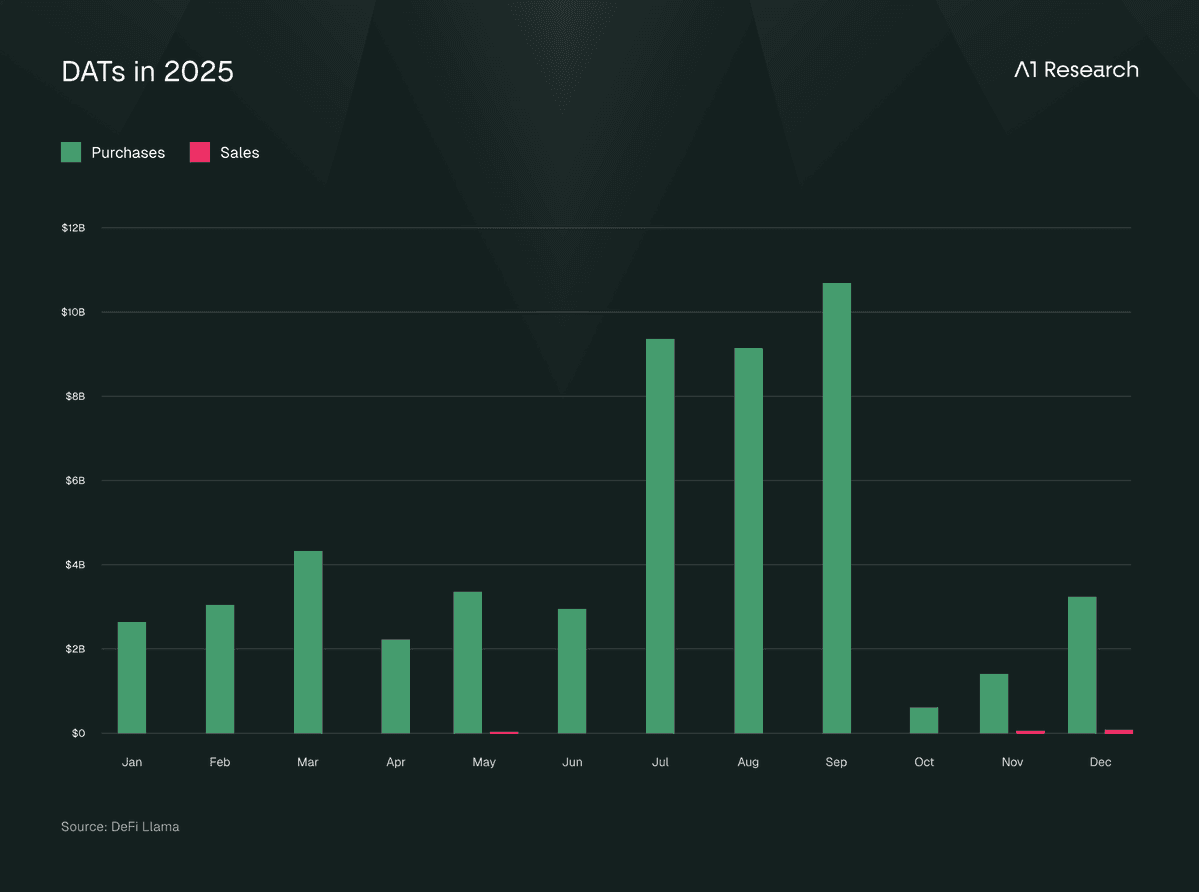

2025 = The year of DATs

Despite many setbacks in 2025, institutional participation in crypto accelerated meaningfully.

Digital Asset Treasuries (DATs) emerged as a key vehicle on-chain, programmable treasuries that enable crypto-native capital management at a global scale. Unlike ETFs, DATs offer real-time capital deployment, full transparency, and flexible governance, while avoiding the regulatory friction, jurisdictional constraints, and passive off-chain nature of traditional products.

Beyond Strategy, several institutional players made sizable bets in this category. Over 50 new DATs launched during the year, with capital expanding beyond Bitcoin into select altcoins.

Throughout the year, the DAT inflows remained net positive, slowing down in October and following months but there was not much selling pressure if not much buying. The concentration still is about 83% in Bitcoin even after newer alts due to Strategy and Bitmine covering 62% of total DAT markets which deal in Bitcoin but Sharplink gaming and Upexi are also doing great here.

More good news?

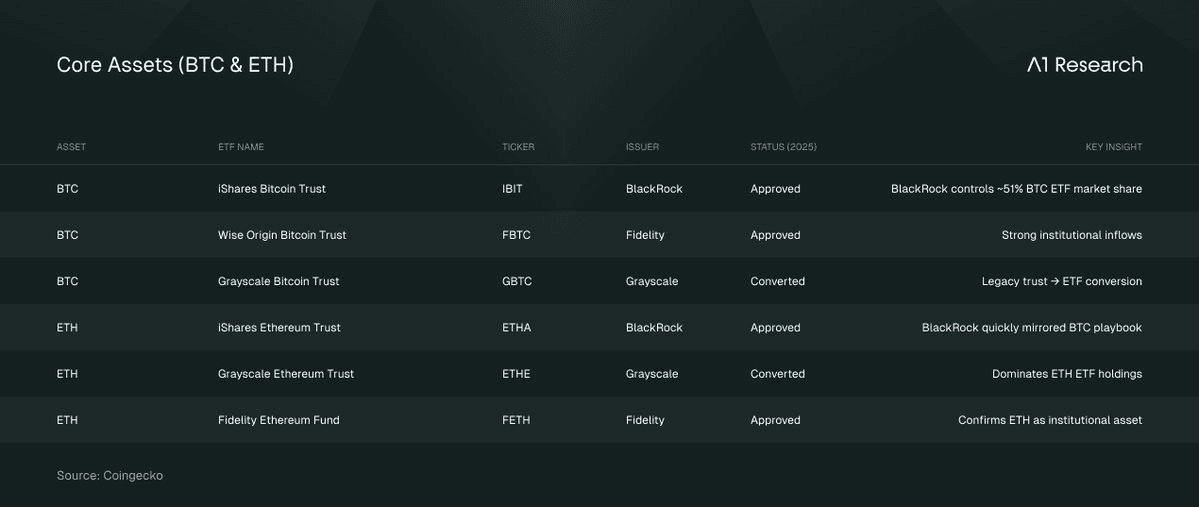

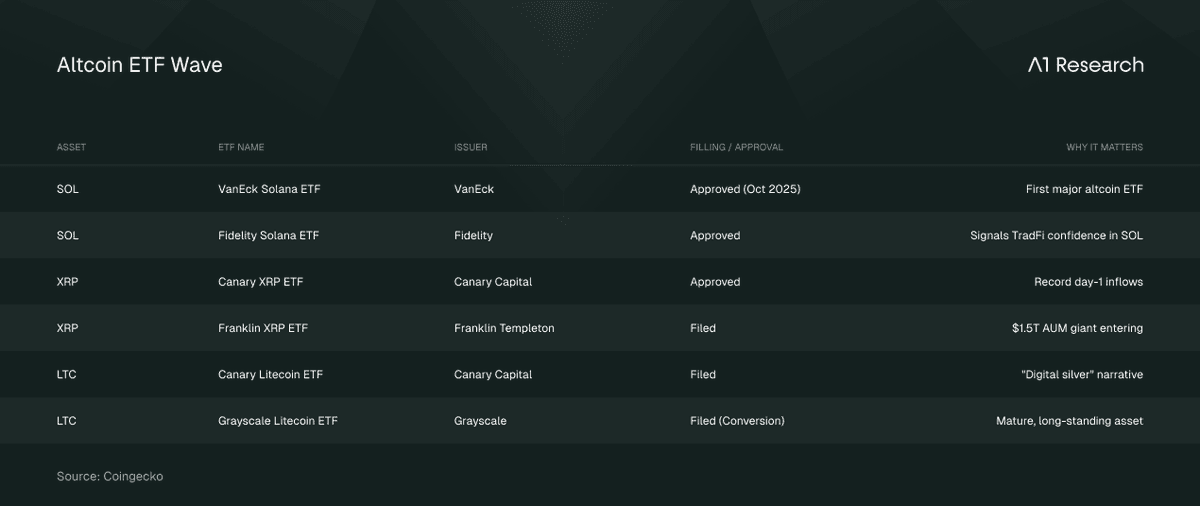

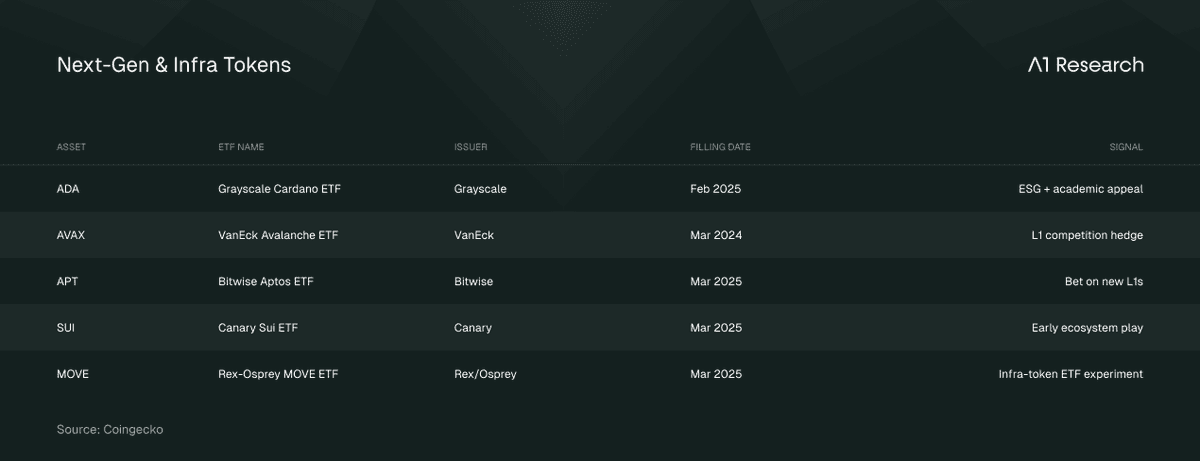

Many new ETFs approved and filed for approval!

Even memecoin ETFs also got filed, incl. DOGE, TRUMP, BONK, PENGU all saw filings in 2025 (even tho not yet approved).

Meanwhile, BlackRock maintained its position as the ETF king, dominating Bitcoin exposure and rapidly expanding into Ethereum.

ETFs moved from being just about "digital gold" to covering altcoins, infrastructure plays, and even cultural assets. This was crypto ETF diversification in real time.

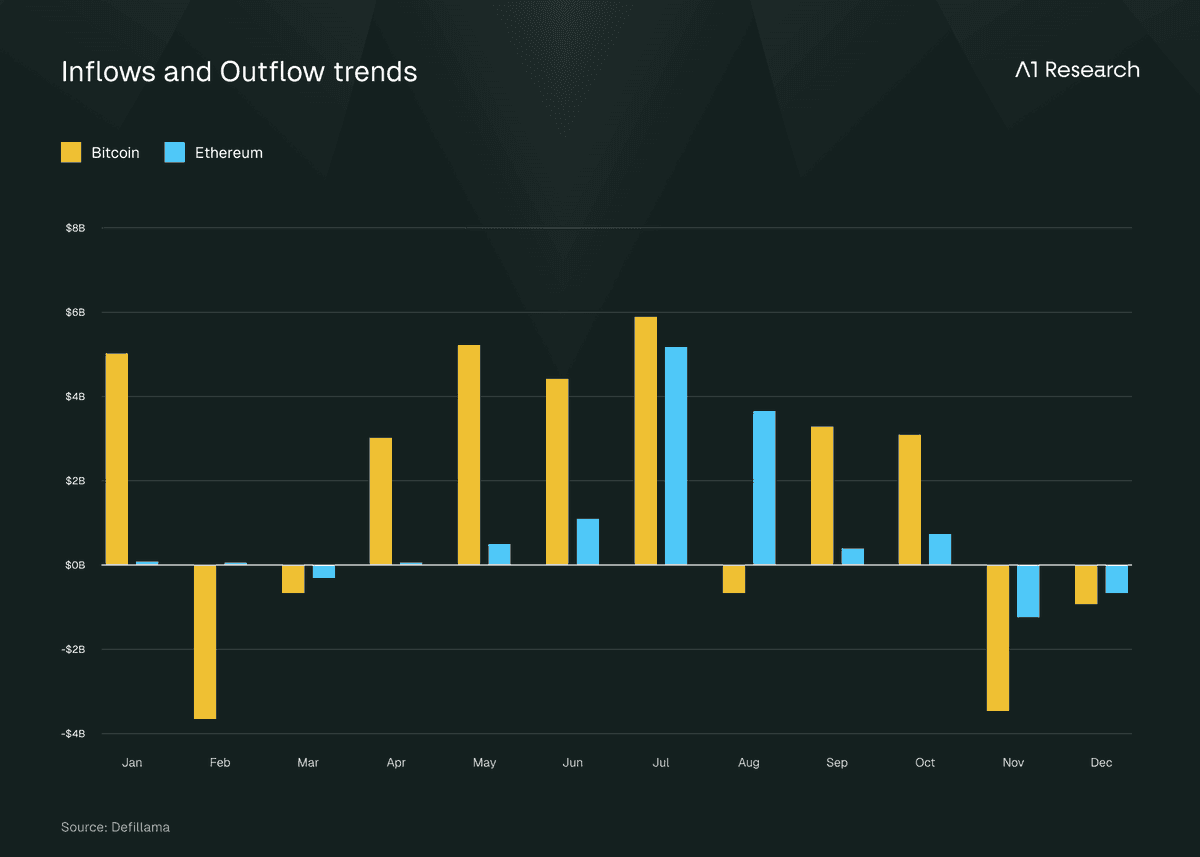

ETF Flows: The Institutional Mood Ring

ETF inflows and outflows throughout the year basically acted as a real-time institutional sentiment tracker.

Q1 Inflow Surge: The year started strong. On January 17, Bitcoin ETFs saw a massive $1.07B single-day inflow. Ethereum had its strongest early-year performance in early February, peaking at $307.8M on February 4.

Mid-Year Volatility: Inflows became more concentrated around specific "mega-days." The notable peak hit on October 6, when Bitcoin ETFs recorded their highest daily inflow of the year at $1.205B. This was right before everything fell apart.

Q4 Outflow Pressure: Sentiment completely shifted in November. Between November 13 and November 20, we saw sustained heavy outflows. November 20 was particularly brutal: $903.2M exited Bitcoin ETFs and $261.6M exited Ethereum ETFs on the same day.

How do ETFs compare to DATs?

ETFs and DATs both had solid consolidation phases in Q2 and Q3 but in Q4 things slowed down, ETFs had a lot of selling pressure but DATs did not sell much and kept buying in smaller amounts showing bullish sentiments.

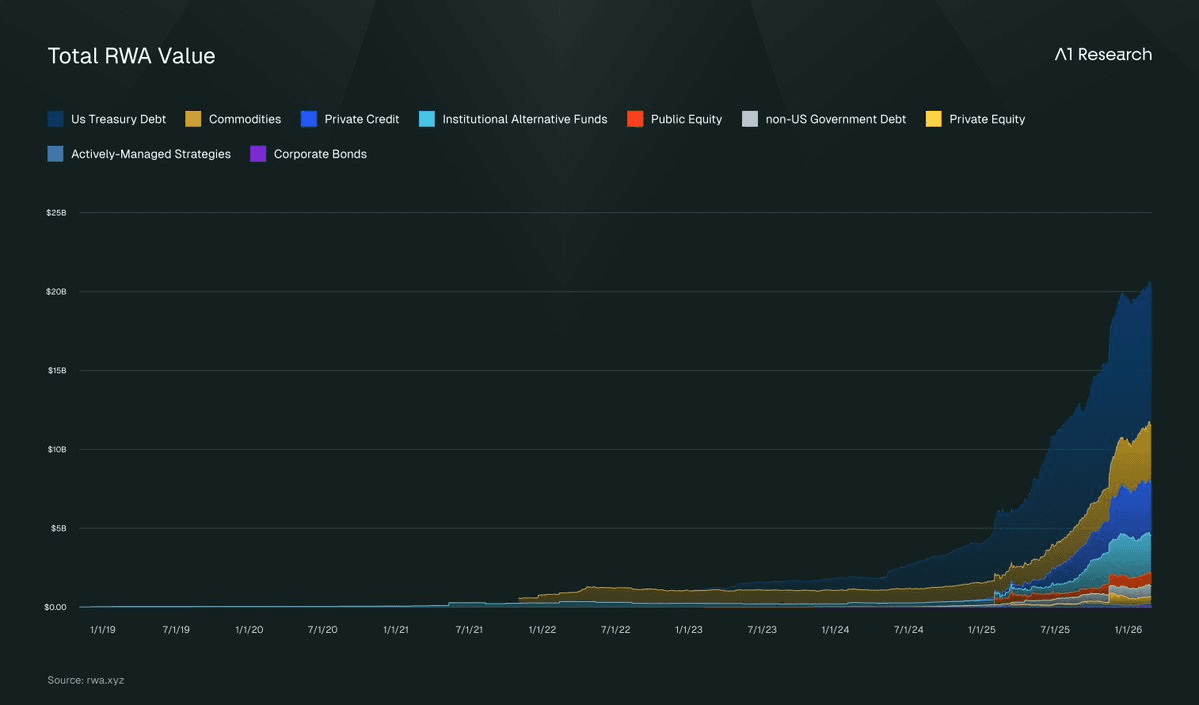

RWAs in 2025: The Tokenization Rally

Total RWA sector grew from TVL of 5.5B to 19B in 2025 (excluding stablecoins), almost a 3x growth, which is cementing tokenization as arguably the most successful institutional use case for blockchain technology to date.

The composition tells the real story. US Treasury debt remains the dominant category, benefiting from the yield environment and serving as the "risk-free" on-chain primitive that underpins DeFi's institutional layer. But the diversification is what's notable: private credit protocols like Maple and Centrifuge saw renewed inflows as TradFi allocators sought yield beyond T-bills, while tokenized commodities (particularly gold) gained traction amid geopolitical uncertainty. The emergence of institutional alternative funds and actively-managed strategies on-chain signals that asset managers are no longer experimenting, they're building.

What's driving the acceleration? Regulatory clarity from the GENIUS Act created a legal framework for tokenized securities, while BlackRock's BUIDL fund crossing $1B AUM provided the institutional stamp of approval that fence-sitters needed. The infrastructure layer matured significantly too: custodial solutions, compliant issuance platforms, and secondary liquidity venues now exist at institutional grade. For TradFi allocators, the value proposition is becoming undeniable as well. 24/7 settlement, fractional ownership, and programmable compliance aren't future promises anymore; they're live in production.

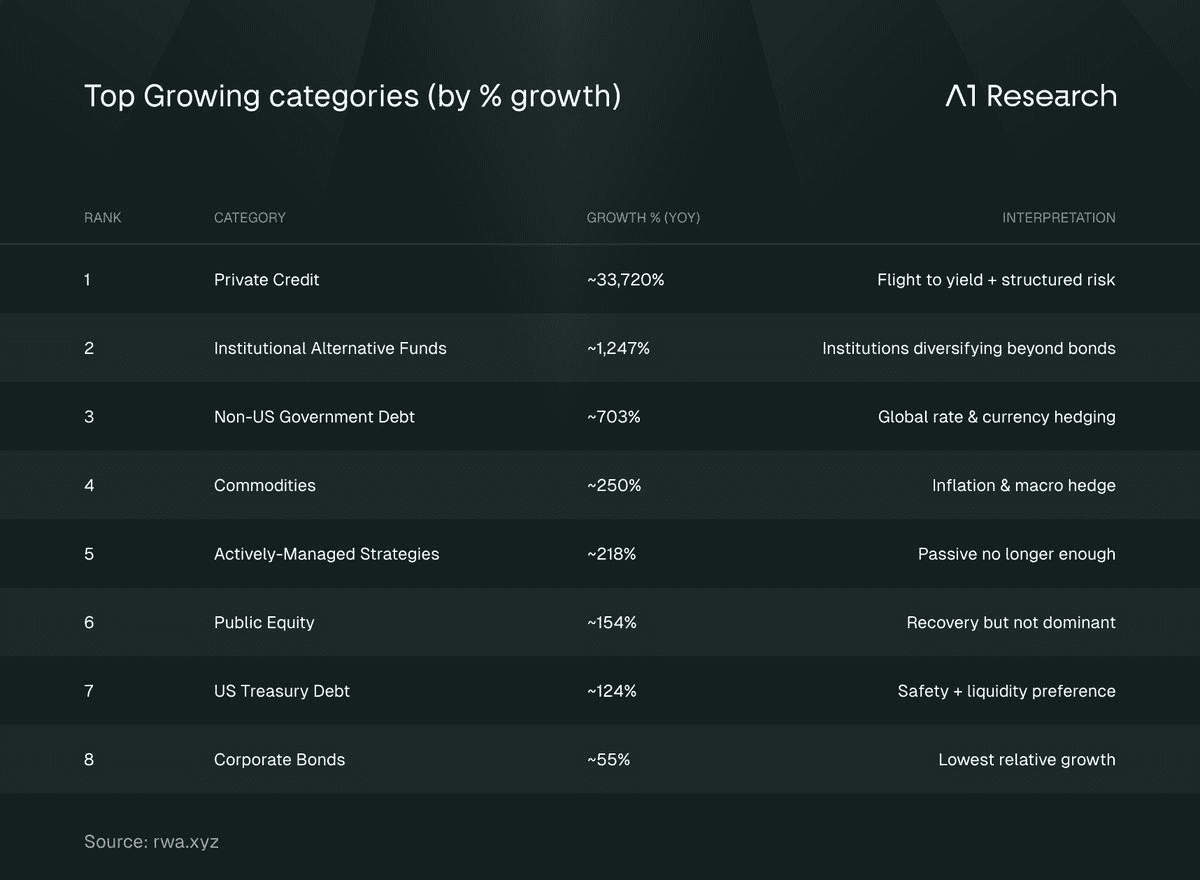

Or more specifically:

Private Credit (+33,720%): The standout performer. Flight to yield plus demand for structured risk products drove massive inflows. Figure, Tradable, and Maple proved that traditional credit underwriting can work on-chain.

Institutional Alternative Funds (+1,247%): The institutional signal. Hamilton Lane and KKR tokenizing fund access via Securitize shows allocators aren't experimenting. They're building permanent on-chain distribution channels.

Non-US Government Debt (+703%): Global rate divergence and currency hedging needs drove demand for geographic diversification. Tokenized EM sovereign exposure with 24/7 liquidity is a genuinely new primitive.

Commodities (+250%): Inflation fears and macro uncertainty made tokenized gold an obvious allocation. Tether Gold and Paxos Gold captured the lion's share.

Actively-Managed Strategies (+218%): Passive is no longer enough. On-chain active management (tokenized hedge fund strategies with composable alpha) is the next frontier.

Public Equity (+154%): Recovery mode, but not the dominant narrative. Backed Finance's holder growth (1.3K to 144K) shows retail demand is there; institutional adoption is next.

US Treasury Debt (+124%): Still the largest category by TVL, but the slowest grower. The "T-bills on-chain" trade is mature. The sector is diversifying beyond safety and liquidity.

Corporate Bonds (+55%): Lowest relative growth. Credit spreads tightened throughout the year, making the yield pickup less compelling versus Treasuries.

If RWAs were the quiet winner, stablecoins were the loud one.

The year of Stablecoins: From Trading Tool to Financial Infrastructure

If there's one sector that absolutely dominated 2025, it's stablecoins. Stablecoins became essential financial infrastructure.

Stablecoin supply grew from $203B to $298B, roughly 47% growth. And here's what matters: this growth was driven by actual use cases, not speculation. Payments, RWAs, remittances, and on-chain yield products all contributed.

The expansion continued despite massive risk-asset volatility everywhere else. While Bitcoin and altcoins were bleeding, stablecoins just kept growing.

The GENIUS Act was a game-changer here. It reframed stablecoins as strategic financial tools rather than regulatory threats. By requiring stablecoins to be backed by Treasuries, the U.S. basically aligned fiscal incentives with on-chain dollar dominance. Brilliant move, honestly.

Looking ahead to 2026, we're likely to see EUR, JPY, and emerging market stablecoins, regional payment rails, and on-chain FX risk management become major themes.

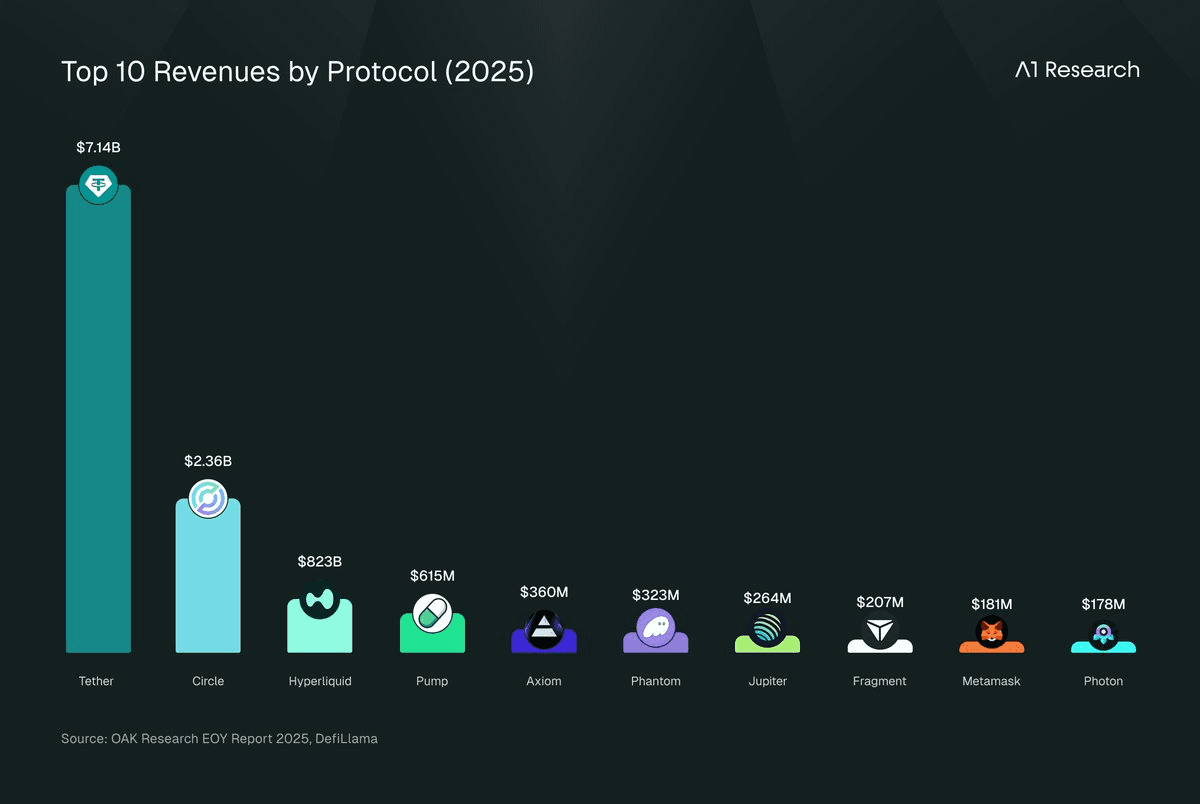

Issuers Won Big Time

Tether and Circle emerged as the most profitable entities in crypto.

Backed by Treasuries and cash equivalents, with near-zero distribution costs, stablecoin issuers may be the most capital-efficient financial businesses ever created.

This also fueled the rise of stablecoin-specific chains like Plasma, Arc, and Tempo built for compliance, predictability, and institutional use.

What about Memecoins?

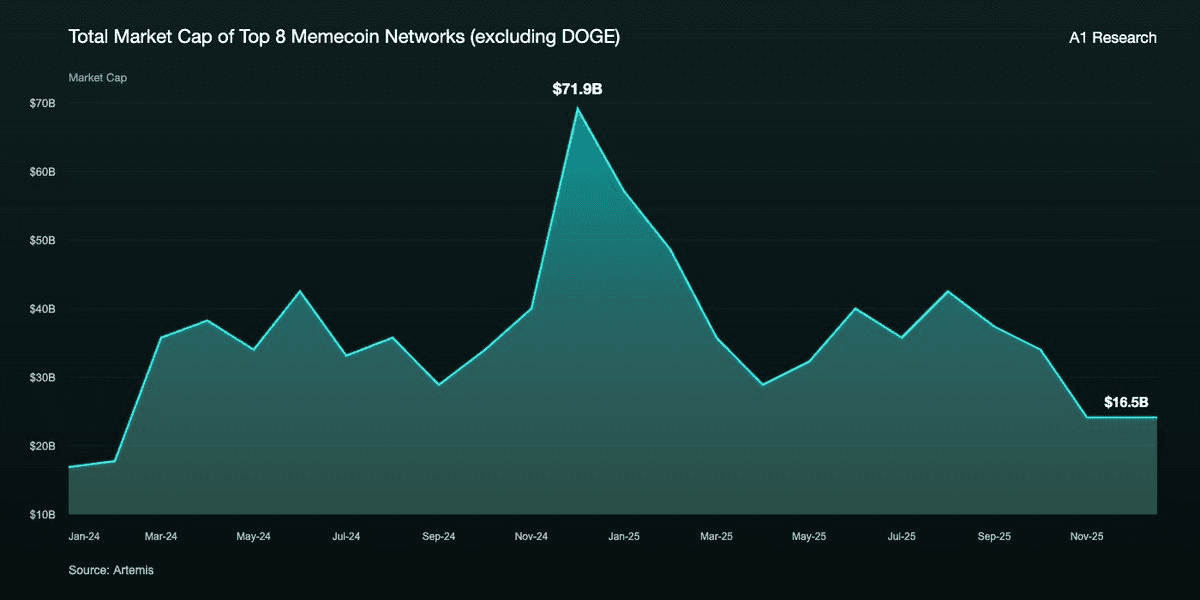

The memecoin market underwent an absolute massacre in 2025.

Total market cap collapsed from $71.9B in December 2024 to just $16.5B by November 2025. This was a decisive unwind of speculative excess, plain and simple.

Platforms like pump.fun exposed the brutal reality of long-tail risk. Over 99% of tokens failed to even cross a $100K market cap. Most projects were illiquid, fragile, and effectively dead on arrival. What looked like an endless opportunity turned out to be extreme survivorship bias.

This reflected a deeper cycle change. The Q4 2024 "memecoin supercycle" was powered by hype, reflexive liquidity, and rapid narrative propagation. In 2025, attention fragmented and decayed much faster. The information asymmetry that gave early participants an edge basically disappeared, compressing upside while amplifying downside risk.

In the current environment, memecoin trading resembles probabilistic gambling more than investing, with negative expected value for the vast majority of participants. That's not FUD though, it's just math.

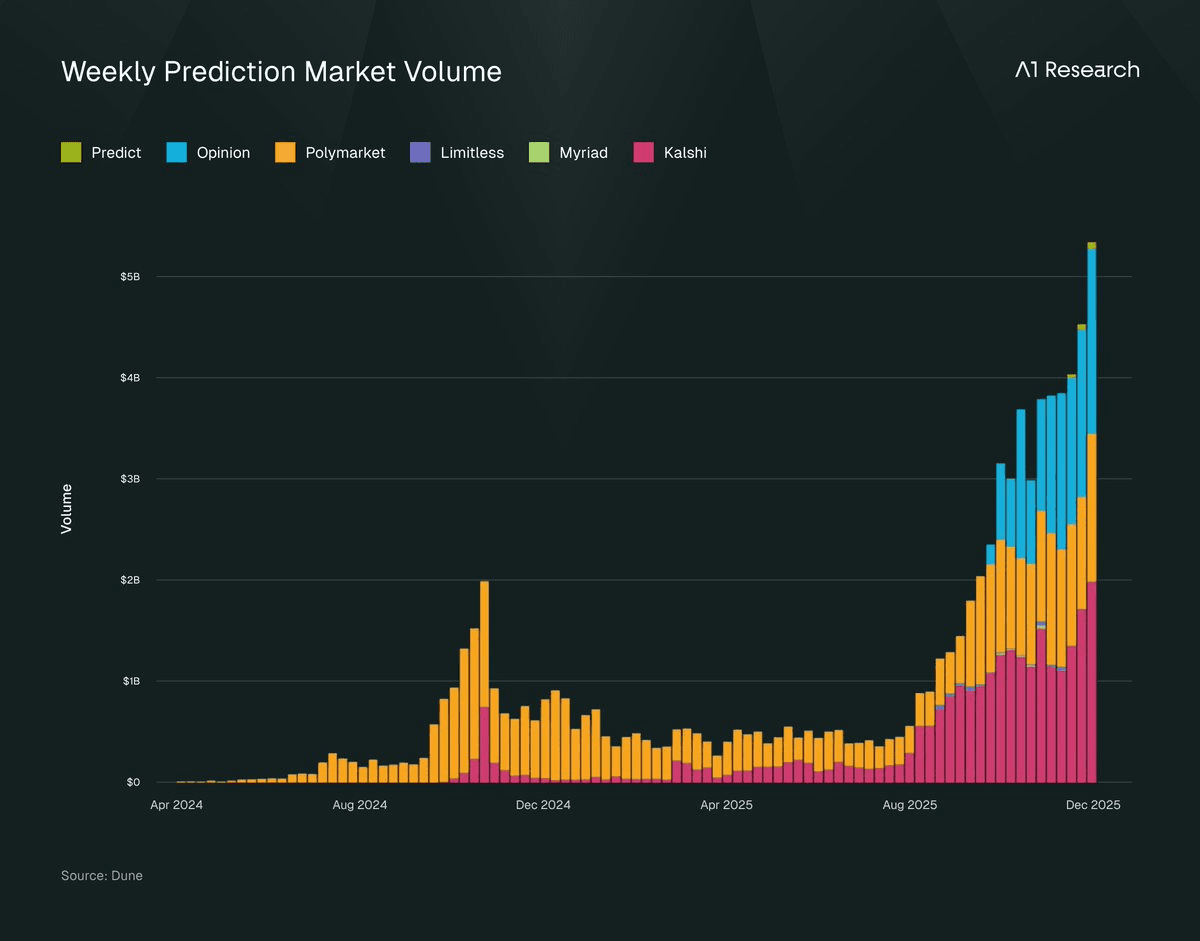

Prediction Markets: Crypto's Mainstream Moment

While memecoins imploded, prediction markets had a breakout year.

Weekly volume in prediction markets surged from $534M to $4.5B in 2025. This was one of the few crypto products that actually reached mainstream users.

Polymarket raised $250M at a $1.5B valuation in January 2025, reflecting early institutional belief in on-chain prediction markets.

Then Kalshi raised $1B at an $11B valuation in December 2025, signaling prediction markets' full transition into regulated, mainstream financial infrastructure.

Kalshi is expected to have their token generation event (TGE) in Q1 2026, which could be one of the most important crypto events heading into the new year.

Prediction markets proved that crypto can build products normies actually want to use. Simple, intuitive onboarding for non-crypto users to access real-world outcomes using stablecoins. That's product-market fit.

Another narrative that promised mainstream adoption? AI agents. But that story played out very differently.

The Crypto x AI Agent Wave: From Hype to Infrastructure

The AI agent narrative in 2025 unfolded in three distinct phases, each revealing how quickly markets can move from excitement to disillusionment and eventually toward real utility.

Phase 1: The Speculative Peak (Late 2024 → January)

AI agents topped in January after an explosive launch cycle in late 2024, when hundreds of agents were deployed in a very short period. Early projects like GOAT or aixbt captured attention, while token prices, agent launches, and experimentation surged across the ecosystem. Platforms such as ElizaOS and Virtuals rallied strongly, driven more by narrative momentum than by actual usage.

However, the reality check came quickly:

Narrative-driven growth outweighed real utility

Most “AI agents” were thin LLM wrappers with no autonomy

No meaningful revenue or sustained user activity

As a result the hype peaked fast, but the underlying substance simply wasn’t there.

Phase 2: The Cooldown

As markets nosedived (and later recovered) from the macro-driven downturn early in the year, these weaknesses became obvious. Capital rotated away, user activity declined, and many agents went dormant or became irrelevant.

Importantly though, this phase was not an indictment of AI itself:

Capital shifted to more defensible sectors

Engagement dropped sharply

Many projects failed to find product–market fit

This was less an AI failure and more a product-market mismatch being priced in after the hype faded.

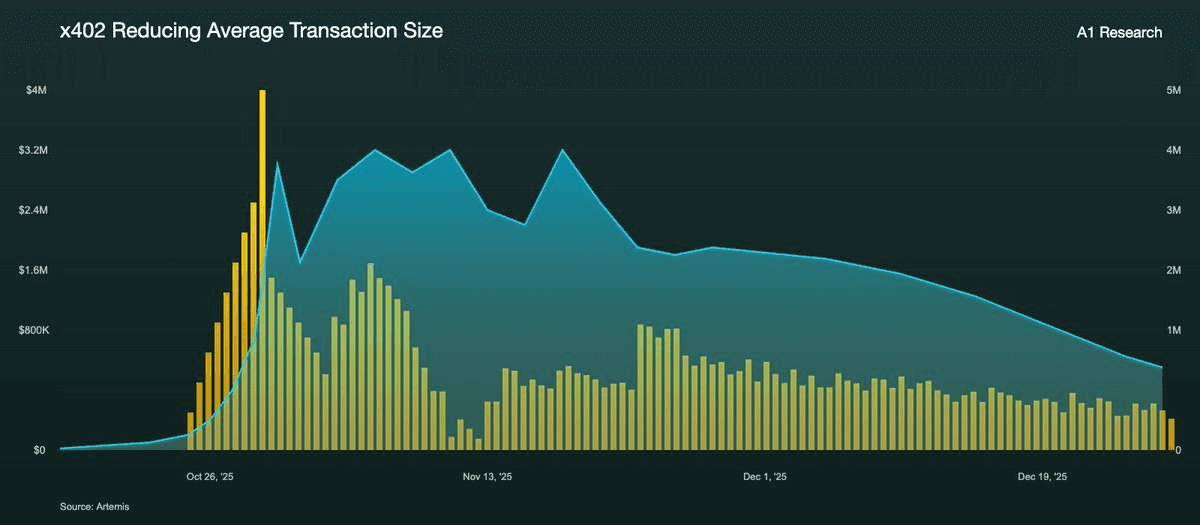

Phase 3: The Second Wave with x402

Later in the year, AI agents regained attention but this time on much stronger footing. The catalyst was Coinbase’s x402 launch, a protocol enabling machine-to-machine payments using HTTP 402 (Payment Required). For the first time, AI agents gained real economic agency.

Why x402 matters:

Native payment rails for AI agents

A full economic stack (payments, execution, coordination)

Agents evolved from chatbots into economic actors

This shift was reflected in real usage. On November 3, x402-related AI-agent activity peaked at over 3 million transactions, marking a transition from narrative-driven hype to infrastructure-backed adoption.

But it was a rough year-end for x402 as average transaction size kept bleeding out, hitting an all-time daily low below $0.05 in late December. Usage is there, value isn’t.

Speaking of value capture problems: let's talk about token launches.

2025: The Year ICOs Returned

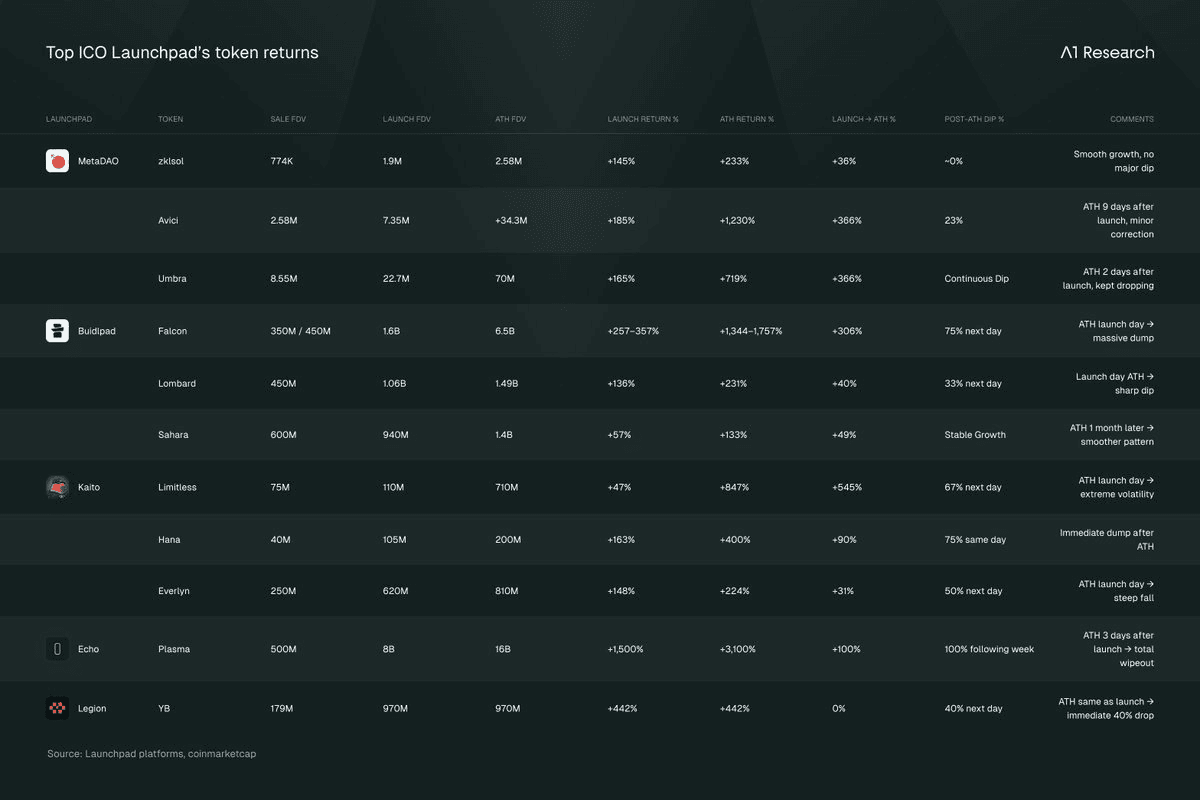

ICOs made a quiet but meaningful comeback in 2025 though in a far more structured and selective form than previous cycles. New launchpads like MetaDAO, Kaito Capital Markets, and Buildlpad emerged as key venues, acting as filters rather than open floodgates. Access, not awareness, became the real bottleneck.

What changed in this cycle:

Airdrops evolved from free token distributions into access passes, mainly whitelisting wallets for ICO participation

Demand surged, with extreme oversubscription becoming the norm

The hype didn't die down (at least initially) with projects like Limitless (~200× oversubscribed) or YieldBasis (~98× oversubscribed) achieving surprisingly strong results, yet performance lagged

Allocations shrank, increasing competition and reducing individual upside

Some launches still delivered strong short-term performance up to 10× from presale to ATH but most tokens sold off soon after TGE. The pattern was clear: ICOs were no longer long-term conviction events, but timing-sensitive opportunities where early access mattered far more than holding.

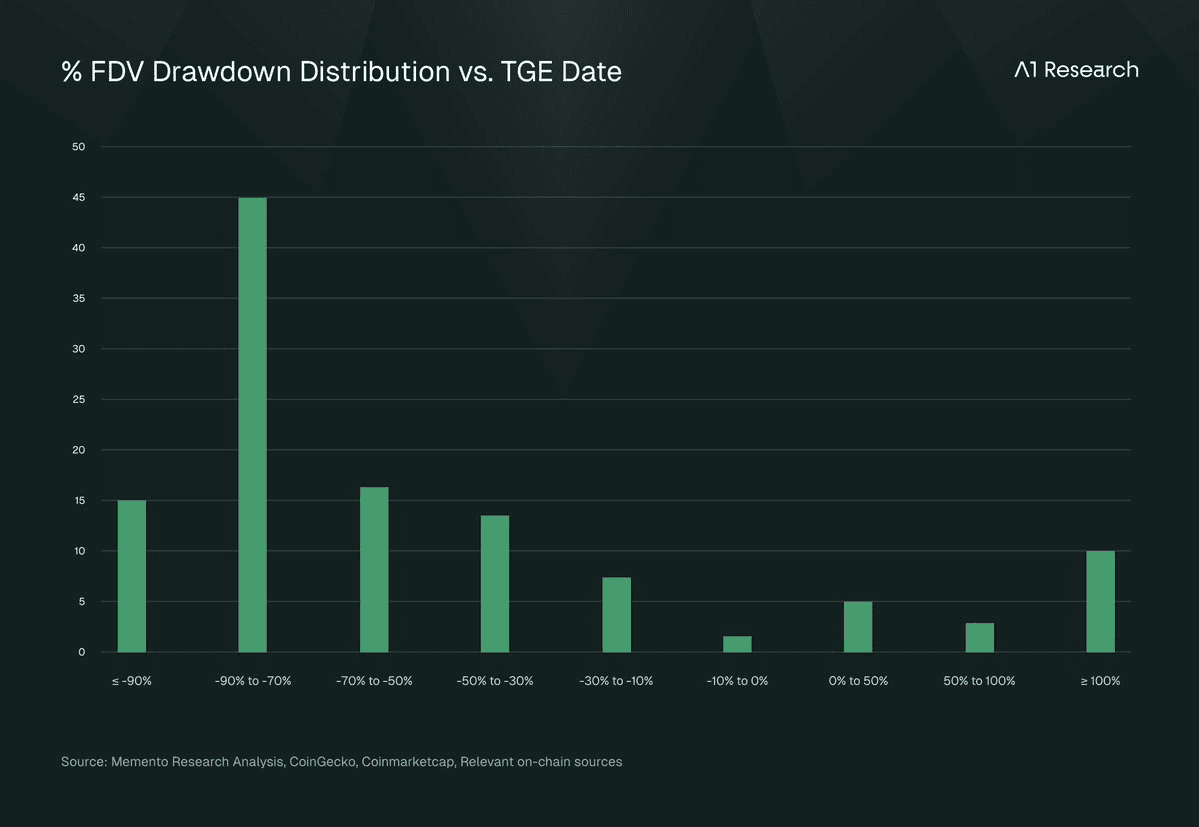

Interestingly, out of 118 major TGEs this year 84.7% are in net negative territory and only 15% are in positive from TGE. TGE used to be the start but nowadays, it seems to the end for protocols. Potentially a healthy cleansing ritual, but more likely a warning signal for our industry.

Only Tokens that are above their TGE launch price are:

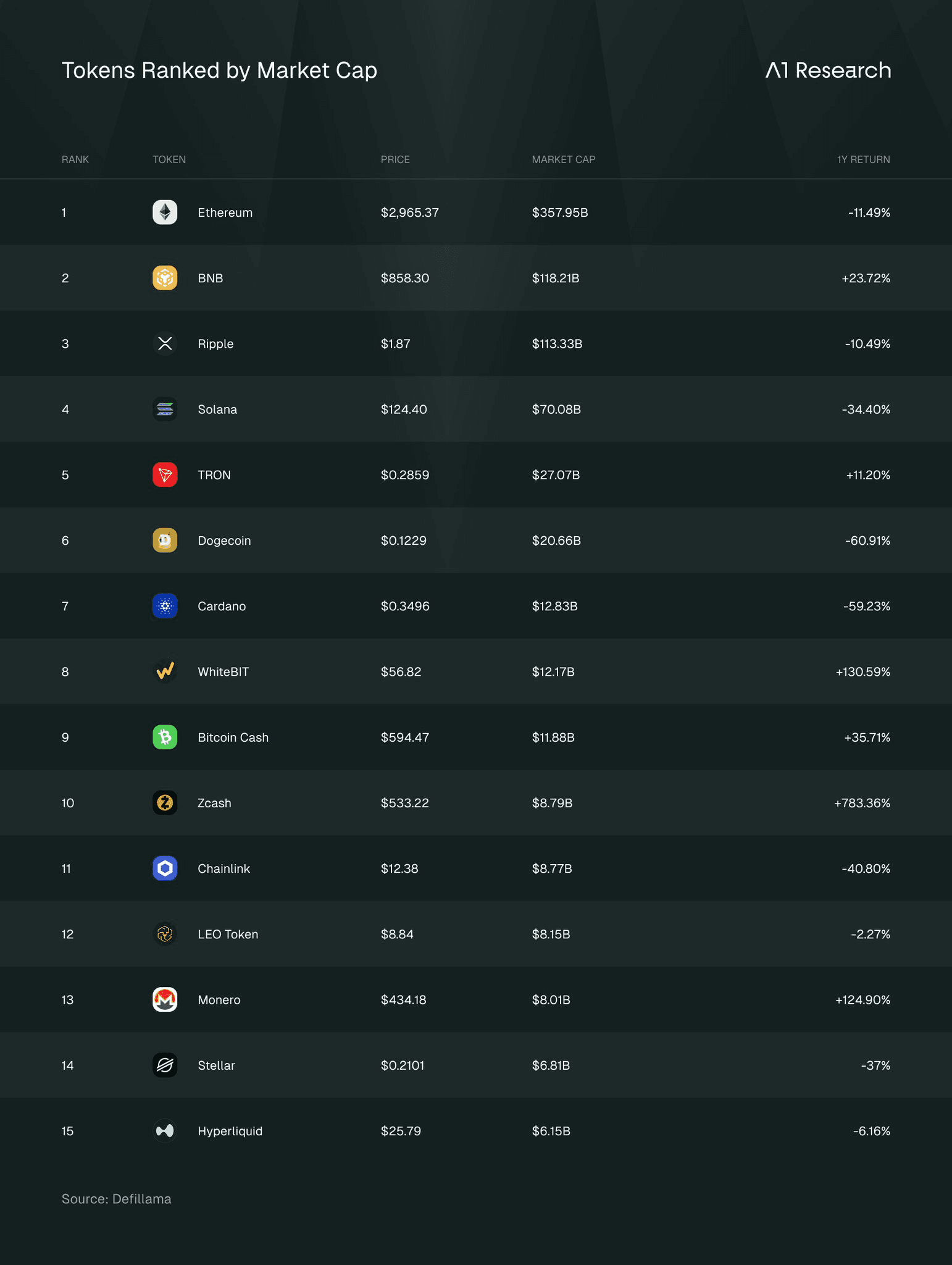

Altcoins in 2025: A Brutal Reality Check

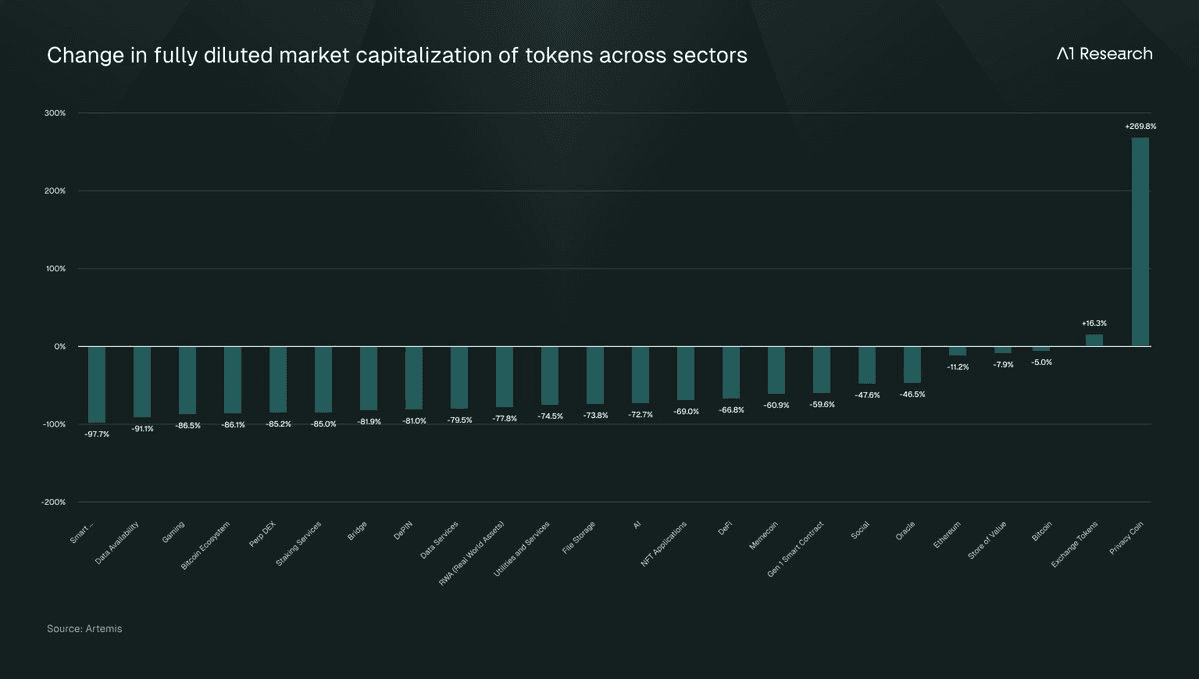

2025 was a bloodbath for altcoins as market breadth collapsed across the board. Out of the top 15 altcoins by market cap, only five managed to post positive returns, underscoring how selective and unforgiving the cycle became. This weakness wasn't limited to a single niche. Almost every altcoin sector bled throughout the year.

The damage was widespread and indiscriminate. Smart contract platforms led the decline at -97.7%, followed by Data Availability (-91.1%), Gaming (-86.5%), and Meme tokens (-86.1%). Even sectors with real usage and revenue like Perp DEXs (-85.2%), Staking Services (-85.0%), and Bridges (-81.9%) saw their token valuations collapse. DeFi (-60.9%), AI (-66.8%), and RWA tokens (-77.8%) all bled despite their sectors showing genuine adoption growth. The disconnect between token performance and underlying fundamentals has never been more stark. Usage up, TVL up, revenue up, token down 70%+.

The only winners? Privacy Coins (+269.8%) benefited from regulatory fears and the broader push toward financial privacy. Exchange Tokens (+16.3%) held up as CEX revenues remained strong. Bitcoin (-5.0%) proved its relative safe haven status within crypto, though its flat performance removed the usual "rising tide" effect that lifts altcoins.

This is no longer a market where participation alone is rewarded. Unlike the 2021 DeFi euphoria where broad liquidity injection lifted all assets, 2025 was selective and unforgiving. Capital preservation replaced speculation, and survival became the primary objective.

The biggest and Only Price Rally: Privacy Coins (ZCash)

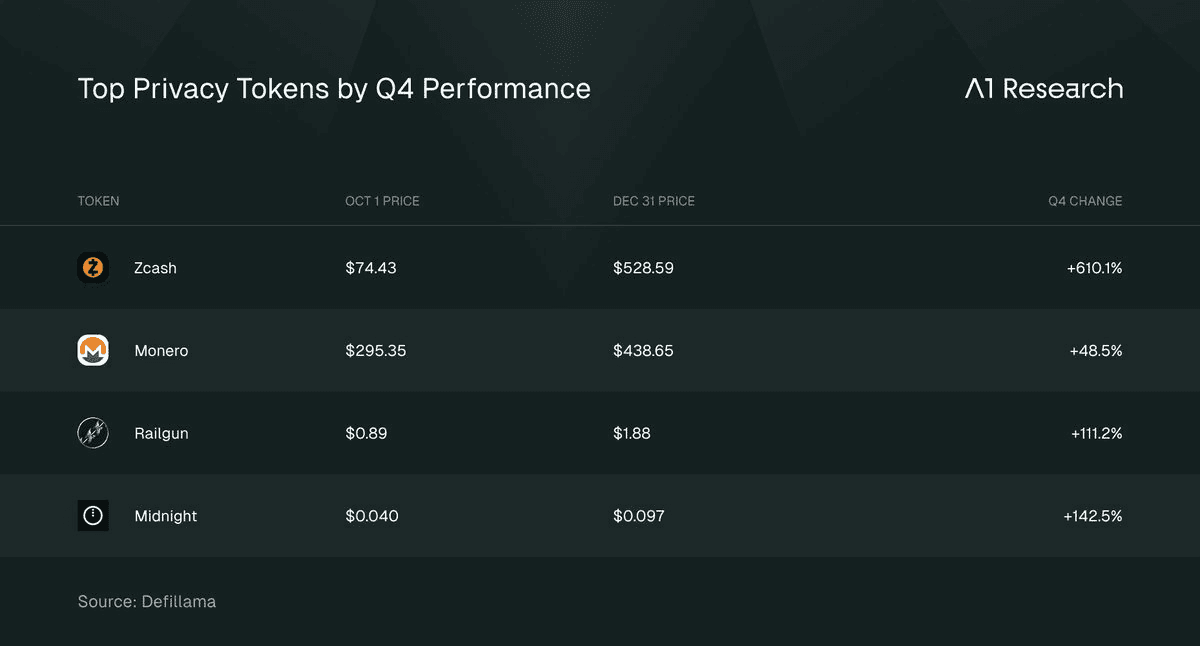

Privacy coins were the only sector to post meaningful gains in Q4 2025, with Zcash leading the charge.

Zcash (ZEC): From $74.43 to $528.59. A +610.1% move in a single quarter. This wasn't a pump and dump; it was sustained accumulation as the privacy narrative took hold.

Monero (XMR): The OG privacy coin moved from $295.35 to $438.65, a +48.5% gain. More modest than Zcash, but Monero's larger market cap and established liquidity made it the "safe" privacy play for larger allocators.

Railgun (RAIL): From $0.89 to $1.88, up +111.2%. Railgun's privacy layer for Ethereum and other EVM chains gained traction as users sought on-chain privacy without leaving their native ecosystems.

Midnight (NIGHT): From $0.040 to $0.097, a +142.5% gain. Smaller cap, higher beta, but it captured the rising tide.

The message from Q4 is clear: while the rest of the altcoin market bled out, capital rotated aggressively into privacy. This wasn't speculation on narratives. It was a fundamental repricing of what financial confidentiality is worth in an increasingly surveilled on-chain environment.

But privacy wasn't the only thing investors were worried about. Security failures reminded everyone that crypto still has fundamental infrastructure problems.

2025: The Year of Hacks and System Failures

Security remained crypto's weakest link in 2025. Total crypto theft reached $3.4 billion according to Chainalysis, with the top three hacks accounting for 69% of all losses. North Korean actors alone stole $2.02 billion (a 51% year-over-year increase), with the Lazarus Group executing at least three of the year's five largest attacks. The industry saw a clear pattern: fewer incidents but dramatically larger losses per attack.

Bybit Exchange Hack (February 21, 2025)

The largest cryptocurrency theft in history. North Korean hackers stole approximately $1.5 billion in Ethereum from Bybit through a sophisticated supply chain attack. The attackers compromised a developer at Safe{Wallet}, the third-party multisig platform Bybit used for transaction security. When Bybit employees went to approve what appeared to be a routine cold-to-hot wallet transfer, the hackers intercepted the request and redirected funds to their own wallets. The FBI officially attributed the attack to North Korea on February 26, 2025, calling it "TraderTraitor." Within weeks, the hackers had converted 86% of the stolen ETH to Bitcoin and dispersed assets across thousands of addresses. Despite being identified, most funds remain unrecovered. The incident demonstrated that even sophisticated institutional-grade custody solutions remain vulnerable to social engineering attacks targeting upstream infrastructure providers.

Cetus Protocol Exploit (May 22, 2025)

The largest DEX on the Sui blockchain was drained of approximately $223 million in under 15 minutes. The attacker exploited an integer overflow bug in a third-party math library (integer-mate) used for liquidity calculations. By deploying worthless spoof tokens and manipulating pool parameters, the attacker made depositing one token appear as millions in value, then withdrew legitimate assets like SUI and USDC far beyond what was actually provided. Sui validators responded by blocking attacker-controlled addresses on-chain, freezing approximately $162 million before it could exit the ecosystem. Around $60 million was bridged to Ethereum. The protocol later recovered through an on-chain community vote and a $30 million loan from the Sui Foundation, but the incident exposed how shared library vulnerabilities can cascade across protocols that appear unrelated.

Balancer V2 Exploit (November 3, 2025)

One of DeFi's foundational protocols suffered a $128 million exploit across six blockchain networks in under 30 minutes. The attacker exploited a rounding error vulnerability in the _upscaleArray function, combined with improper access controls in the manageUserBalance function, to execute 65+ micro-swaps within single batchSwap transactions. Each swap compounded precision errors that allowed the attacker to artificially suppress pool token prices and extract value through repeated arbitrage. Ethereum was hit hardest with approximately $99 million drained. Despite undergoing 11 audits by firms including OpenZeppelin, Trail of Bits, and Certora, the flaw went undetected. Balancer's TVL halved from $442 million to $214.5 million within hours. Berachain executed an emergency hard fork to recover affected funds on its network. The attack marked Balancer's third major security incident since 2020, reinforcing that audit histories alone do not guarantee protocol security.

Upbit Exchange Hack (November 27, 2025)

South Korea's largest cryptocurrency exchange suffered a $36-38 million hot wallet breach targeting Solana-based assets including SOL, USDC, BONK, JUP, TRUMP, and RENDER. The attack occurred exactly six years to the day after Upbit's 2019 hack (342,000 ETH stolen, attributed to North Korea's Lazarus Group). Security researchers identified potential weaknesses in Upbit's digital signature infrastructure that may have allowed private key derivation from on-chain transaction history. The exchange suspended all deposits and withdrawals within 18 minutes of detection and committed to covering all user losses with corporate reserves. Upbit subsequently moved 99% of assets to cold storage. The incident coincided with parent company Dunamu's acquisition by Naver Financial, raising questions about timing and internal security standards during corporate transitions.

USDe "Depeg" (October 10, 2025)

We covered this earlier, but worth repeating: Ethena's synthetic stablecoin USDe crashed to $0.65 on Binance during a 40-minute window, even though it maintained its peg at approximately $1 on other exchanges and DeFi venues. The trigger was Binance's internal pricing system, which used its own order book data rather than external oracles to value collateral. When liquidity evaporated, USDe, wBETH, and bnSOL were all mispriced, triggering automated liquidations across nearly 1.7 million traders and wiping out $19 billion in leveraged positions. Binance later reimbursed approximately $283 million to affected users and implemented pricing reforms. The incident exposed how centralized exchange infrastructure failures can cascade into market-wide events that dwarf any individual protocol exploit.

The Pattern

The painful irony of 2025 is stark. On one side, crypto achieved genuine institutional adoption with proper regulatory frameworks. On the other, the year's largest losses came from a combination of nation-state attackers targeting supply chain vulnerabilities (Bybit), mathematical edge cases in audited code (Cetus, Balancer), basic operational security failures (Upbit), and centralized infrastructure single points of failure (Binance/October 10). State-sponsored attackers are becoming more sophisticated, audits remain insufficient, and the industry's reliance on centralized chokepoints creates systemic risks that decentralization was supposed to eliminate.

About those regulatory frameworks, though. 2025 was a tale of two continents.

The Regulatory Environment in 2025

Regulation in 2025 created a stark divergence: the United States embraced institutional enablement while Europe prioritized compliance over competitiveness.

United States: From Enforcement to Enablement

The U.S. regulatory landscape underwent a complete transformation, replacing years of "regulation-by-enforcement" with frameworks designed to integrate crypto into the financial system.

The landmark achievement was the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act), signed into law by President Trump on July 18, 2025. The Senate passed the bill on June 17, 2025, by a bipartisan vote of 68-30; the House followed on July 17, 2025, with a 308-122 vote. This legislation established the first comprehensive federal framework for payment stablecoins, requiring 100% reserve backing with liquid assets, monthly public disclosures of reserve composition, strict AML compliance under the Bank Secrecy Act, and priority status for stablecoin holders over all other creditors in bankruptcy. The Act explicitly exempts permitted payment stablecoins from securities classification, removing years of jurisdictional uncertainty.

The SEC, under Chairman Paul Atkins, launched "Project Crypto" on July 31, 2025, a Commission-wide initiative to modernize digital asset oversight. The SEC Crypto Task Force, led by Commissioner Hester Peirce, convened multiple roundtables on custody, DeFi, tokenization, and financial privacy. By November, Atkins announced plans for a formal token taxonomy anchored in Howey analysis, distinguishing between digital commodities/network tokens (likely not securities), tokenized securities (remain securities), digital collectibles, and digital tools. The SEC's posture shifted from adversarial to collaborative: the lawsuit against Binance was dismissed with prejudice on May 29, 2025, and on September 5, 2025, SEC Chair Atkins and CFTC Acting Chair Caroline Pham issued a joint harmonization statement announcing coordinated regulatory efforts.

On market structure, the House passed the CLARITY Act on July 17, 2025, by a vote of 294-134. This legislation would grant the CFTC exclusive jurisdiction over digital commodity spot markets while preserving SEC authority over investment contract assets. However, Senate passage was delayed on 15th of January 2026. Late-stage amendments drew fierce industry opposition, and on January 14, 2026, Coinbase CEO Brian Armstrong withdrew support, citing concerns over provisions that would effectively ban tokenized equities, impose DeFi restrictions, and eliminate stablecoin rewards under bank lobbying pressure. The scheduled January 15 markup was subsequently postponed to late January. Passage requires 60 votes, and bipartisan support remains uncertain heading into midterm election pressures.

Europe: MiCA's Unintended Consequences

Europe took the opposite approach. With MiCA fully enforced as of December 30, 2024, the EU achieved regulatory clarity but at a steep cost to innovation.

The compliance burden proved punishing. Minimum licensing costs surged 6x from approximately €10,000 to €60,000, with full compliance for large exchanges exceeding €500,000 annually. Enforcement was aggressive: by mid-2025, over €540 million in penalties had been issued, 28 crypto firms had licenses revoked, and ESMA conducted 230+ audits of crypto businesses in H1 2025 alone.

The market impact was severe. EU crypto venture funding plummeted 70% from its 2022 peak of $5.7 billion. By June 2025, 75% of Europe's 3,167 VASPs were projected to lose registration status under grandfathering rules, and only 12 CASPs had obtained MiCA licenses. Approximately 18% of existing platforms shut down or exited the EU market entirely. The regulatory burden extends beyond MiCA: CASPs must also comply with DORA (effective January 2025) and the Travel Rule (effective December 2024, no grace period).

The result: widespread firm migration to the UK, Switzerland, and other non-EU jurisdictions. Europe's blockchain job market collapsed from over 100,000 positions in 2022 to approximately 10,000 by 2025. Universities are expanding blockchain programs, but graduates are relocating to the U.S., UAE, or Asia, drawn by higher salaries and more venture capital.

The Divergence

The contrast is now structural. The U.S. is positioning crypto as strategic infrastructure, with the GENIUS Act explicitly framing stablecoins as tools for maintaining dollar reserve currency dominance. Europe is treating crypto as a consumer protection problem requiring containment. This divergence will shape 2026: U.S. regulatory clarity is attracting institutional capital and onshoring crypto businesses, while Europe's framework favors large incumbents and drives startups elsewhere.

Winners & Losers

What Won ✅

Institutions via ETFs & DATs

Bitcoin as digital collateral (core conviction asset)

Stablecoins as financial infrastructure

Issuers (Tether, Circle) earning real yield

RWAs (credit, treasuries, equities)

ZK & scaling infrastructure

Privacy coins (clear outperformers)

AI infra (payments + x402, not hype)

Prediction markets → mass onboarding

What Lost ❌

TGEs as wealth creation events

High-FDV token launches

Bitcoin + Altcoins price (broadly)

Memecoin supercycle

Narrative-driven hype

Over-leveraged trading

Security & operational maturity

Takeaway: Real utility and institutions won. Hype, leverage, and dilution lost.

Closing Notes

2025 was the year crypto stopped being a mere sideshow and started becoming real infrastructure with actual institutional adoption.

The gap between what survived and what didn't is clear. Institutions accumulated through drawdowns. Stablecoins grew while everything else bled. RWAs quietly 3x'd, while most TGEs became exits for teams, memecoins collapsed, and leverage got wiped on 10/10.

This wasn't a bear market though. It was a filter.

What remains is leaner, more institutional, and more real. ETFs as access rails, DATs as conviction signals, stablecoins as payment infrastructure, and privacy as an emerging institutional requirement.

The retail-driven "everything pumps" era is over. What's replacing it is selective, thesis-driven, and utility-anchored.

2026 likely won't reward participation. It will reward precision.

Recommended Articles

Dive into 'Narratives' that will be important in the next year