DeFi

Feb 2, 2026

11 min read

Executive Summary

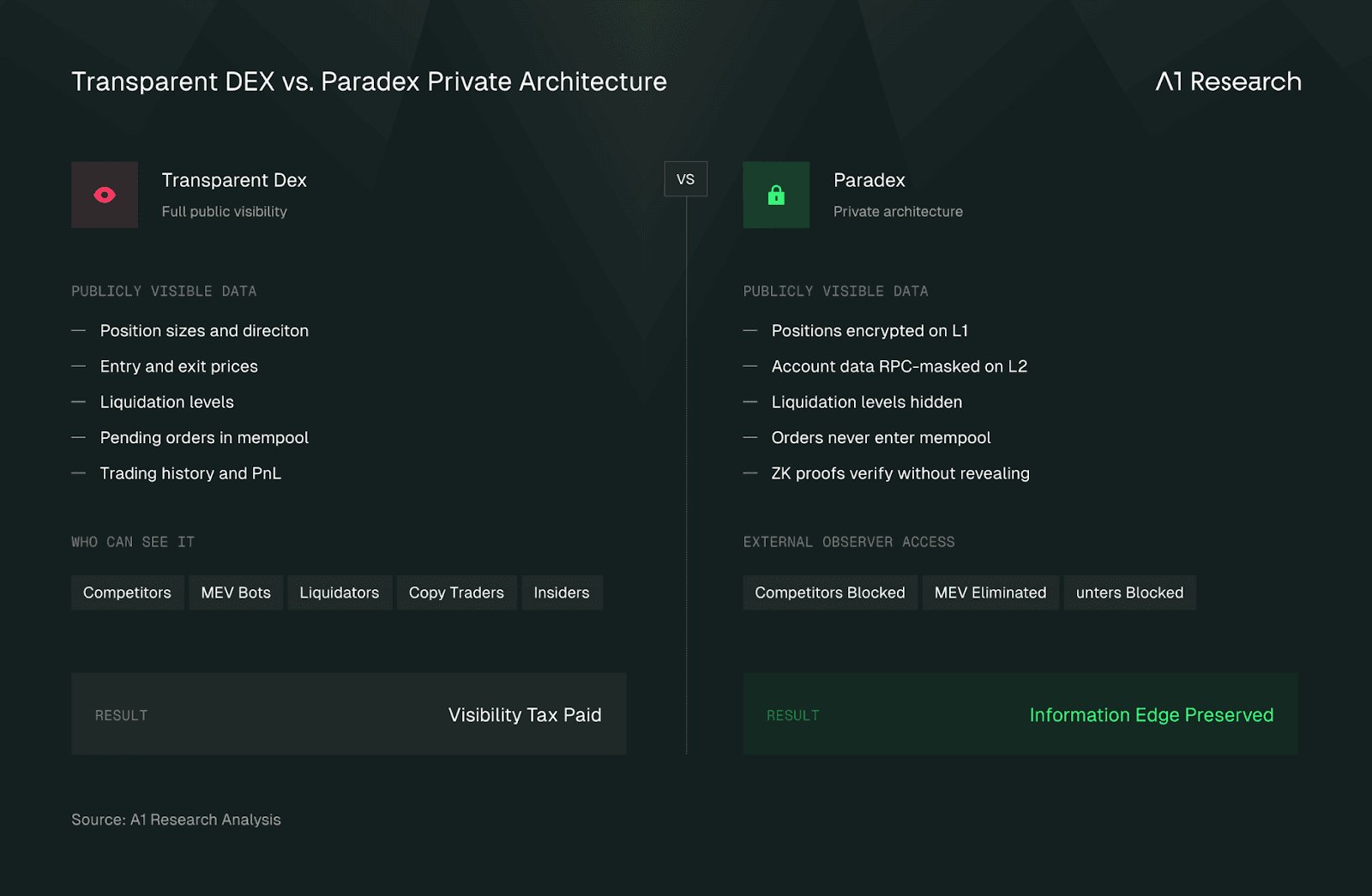

In the current decentralized trading landscape, every institutional trader pays a hidden "Visibility Tax." When position sizes, entry points, and liquidation levels are broadcast to public mempools, sophisticated players aren't just trading, they are being hunted. Paradex represents one of the most advanced attempts to mitigate the structural limitations of transparent onchain trading for large participants.

Operating as the first private Starknet appchain in production, Paradex is not merely adding privacy features to a DEX. It is building the onchain successor to the institutional dark pool. By combining zero-knowledge proof technology with encrypted state management, Paradex is substantially mitigating the fundamental "Transparency Paradox" that has kept trillions in institutional capital on the sidelines. In 2025, privacy became a vertical, in 2026, Paradex is positioning it as a baseline for institutional participation.

The platform's architecture combines said privacy with Ethereum settlement and full self-custody. Users benefit from state diffs encrypted on Ethereum L1, RPC-masked account data on L2, and off-chain order flow processing, all while maintaining the ability to withdraw to Ethereum regardless of operator behavior.

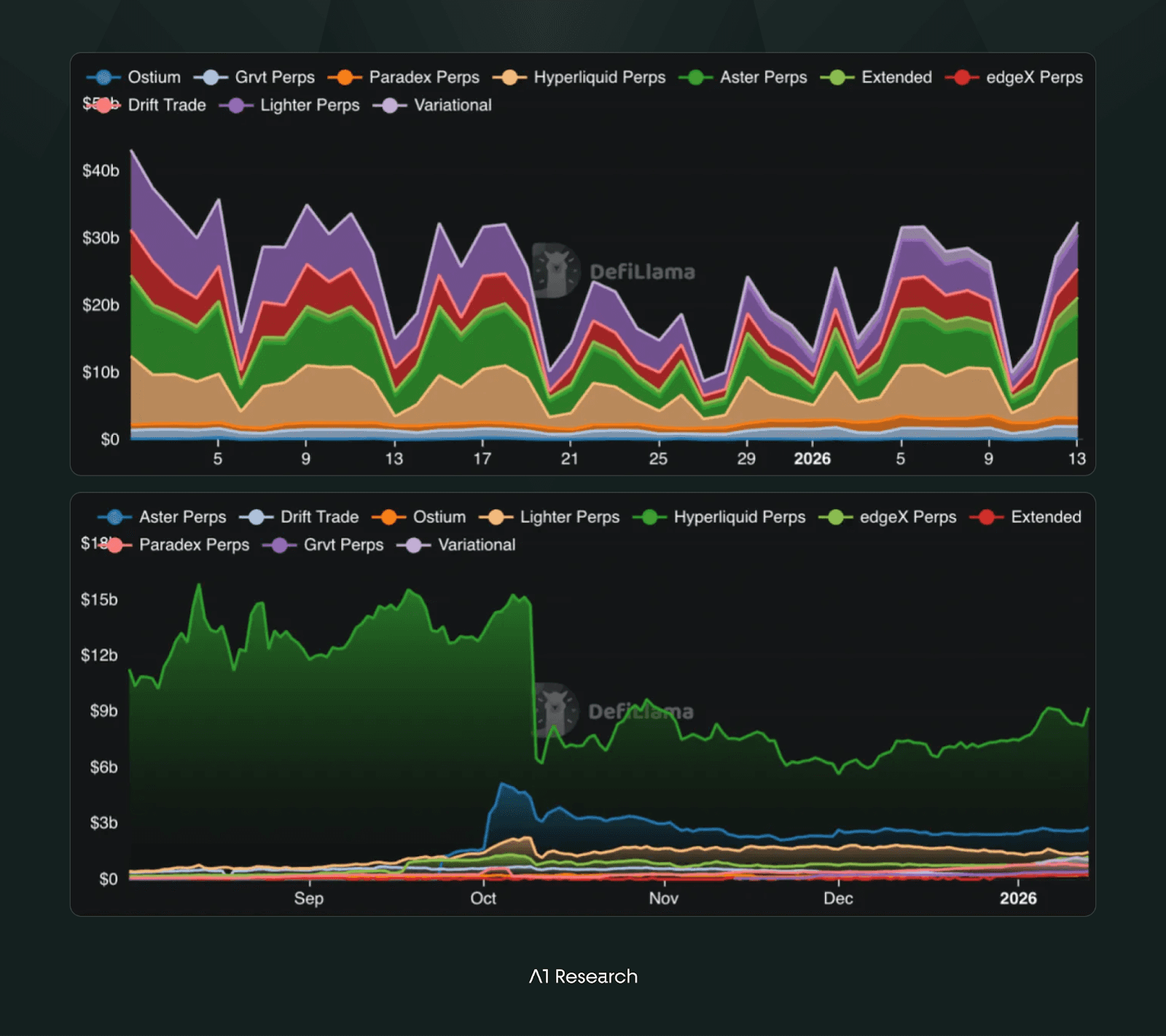

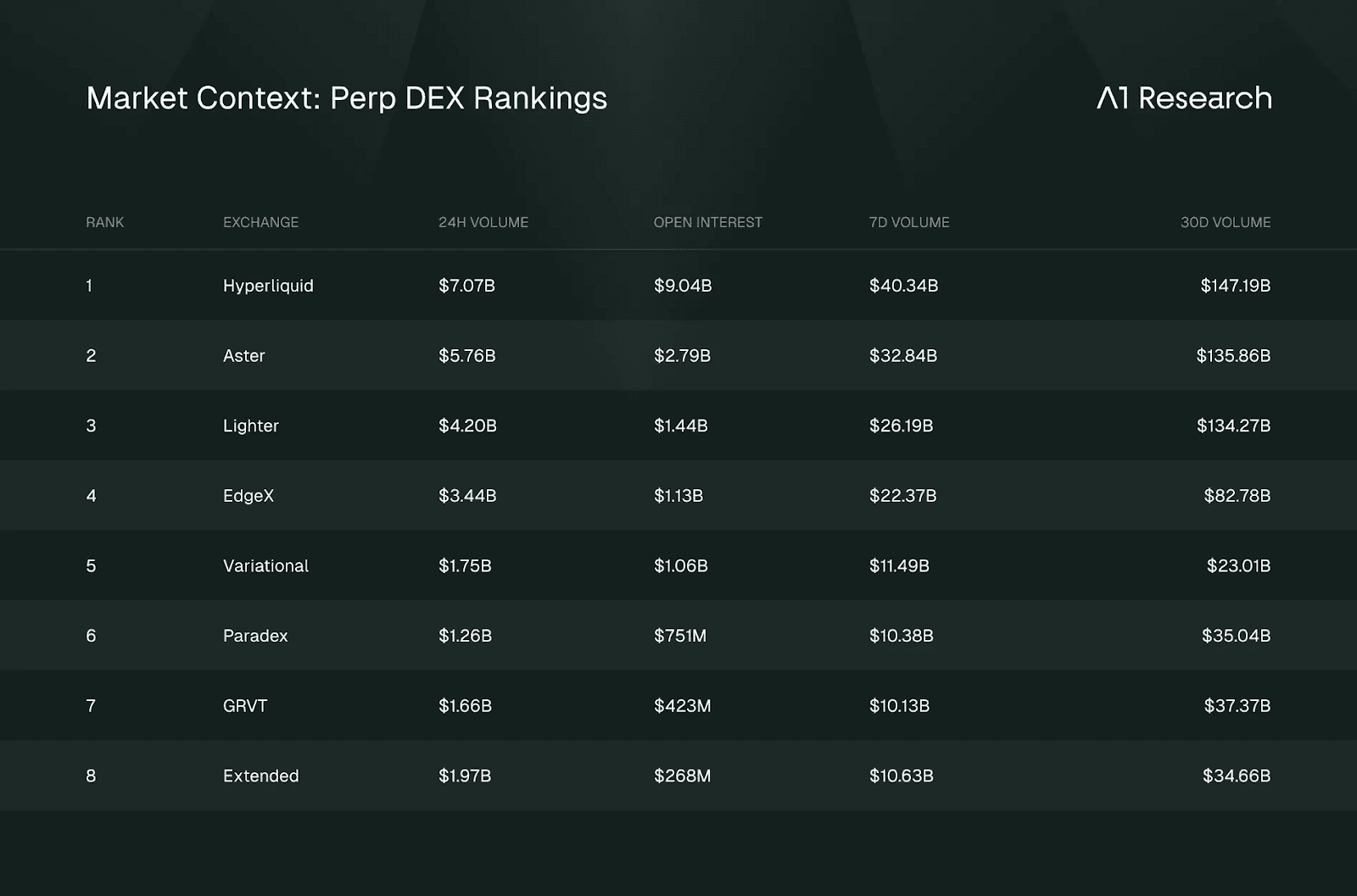

The PMF is already evidenced by the adoption data. Paradex regularly ranks sixth among decentralized derivatives exchanges by 24-hour volume, processing over $1.2 billion daily with $751 million in open interest (DefiLlama, January 13, 2026). The growth trajectory is also exceptionally strong: monthly volume increased from approximately $8 billion in July 2025 to $32 billion in December 2025, representing 4x growth over six months and approximately 25% month-over-month compounding. The platform operates with zero trading fees for retail makers/takers and 2bps for pro takers (on non-retail users). With >100 live perpetual markets, a Retail Price Improvement (RPI) system, and perpetual options, Paradex has established itself among the leading perp DEX platforms. Capital efficiency is notable too with an Open Interest to TVL ratio of 3.3x compares favorably to Hyperliquid's 2.2x, suggesting effective utilization despite smaller absolute size.

Paradex’s institutional credibility is reinforced by Paradigm backing (the institutional crypto liquidity network processing approximately $1.2 billion in daily options volume, not the VC) and team composition rooted in deep TradFi experience. Built in close collaboration with StarkWare as the first production appchain on the SN Stack, Paradex benefits from direct access to market-leading ZK infrastructure.

1. Introduction

Every trade you make on a transparent blockchain is a signal to the market. Your position sizes, your entry points, your liquidation levels, your profit targets: all of it broadcast to anyone willing to look. For retail traders, this is an inconvenience. For institutions managing serious capital, it is an insurmountable barrier, putting their capital at risk.

The promise of decentralized finance has always been compelling. Permissionless access, self-custodial control over assets, 24/7 markets, and settlement guarantees backed by cryptography rather than mere counterparty trust. These properties attracted billions in capital and spawned an entire ecosystem of financial applications. Yet, despite all its innovation, DeFi has failed to attract institutional capital at scale. The reason is not just regulatory uncertainty or technology limitations. The fundamental barrier is information leakage arising from a lack of privacy.

When a pension fund accumulates a $100 million position on a transparent blockchain, the entire market watches. When a hedge fund's liquidation levels become public knowledge, competitors exploit them. When a market maker's inventory is visible to all, every counterparty can front-run their hedging activity. This transparency, often celebrated as a key feature of blockchain technology, creates an adversarial trading environment fundamentally incompatible with how institutional capital operates.

Paradex was built to solve this problem. Rather than treating privacy as an optional feature to be added later, the team designed privacy into the architecture from inception. The result is a perpetual futures DEX that delivers comprehensive trading privacy. Encrypted positions, masked account data, and off-chain order flow that never touches a public mempool.

This report provides a comprehensive analysis of Paradex's technical architecture, privacy implementation, product design, competitive positioning, and risk profile. We examine what the platform has built, the trust assumptions it requires, and the roadmap ahead. For institutional participants evaluating onchain derivatives infrastructure, this analysis offers a framework for understanding what Paradex offers and what risks remain. For capital allocators and crypto-native users, this is guidance to understand the ever-evolving perp DEX market and the unique position that Paradex has within the space.

Key Assumptions

This analysis assumes:

Institutional participants will increasingly prioritize position confidentiality over maximum liquidity as onchain derivatives mature.

Regulatory frameworks will permit privacy-preserving trading venues with authenticated users.

Architectural privacy advantages cannot be easily retrofitted by competitors without fundamental redesign.

2. The Privacy Imperative

2.1 The Transparency Problem in Onchain Trading

As outlined earlier, the transparency inherent to public blockchains creates an adversarial trading environment that is fundamentally incompatible with institutional requirements. Every position, entry, exit, and liquidation level is publicly visible on transparent blockchains. Sophisticated actors systematically exploit this transparency through strategies like "whale hunting" (targeting large positions for liquidation), which has become a documented, profitable activity. The James Wynn case and numerous similar (yet less public) incidents demonstrate that large positions on transparent venues become targets rather than merely trades.

The institutional trading paradigm requires confidentiality as a foundational principle. Traditional finance institutions are used to operating with strict information barriers. Pre-trade anonymity is essential for fair price discovery. When markets can see a large buy order approaching, they front-run it, degrading execution quality. Position confidentiality prevents adverse selection and predatory trading. These are not just preferences though, they are requirements embedded in how institutional capital operates.

Current DEX transparency is fundamentally incompatible with these requirements. A pension fund cannot broadcast a $100 million position accumulation to the market. A hedge fund cannot reveal liquidation levels to competitors. An institutional market maker cannot expose inventory and hedging strategies to the entire market. These constraints are not going away. They are features of how serious capital must operate to fulfill fiduciary duties and maintain competitive edge.

2.2 The Scale of Capital Waiting on the Sidelines

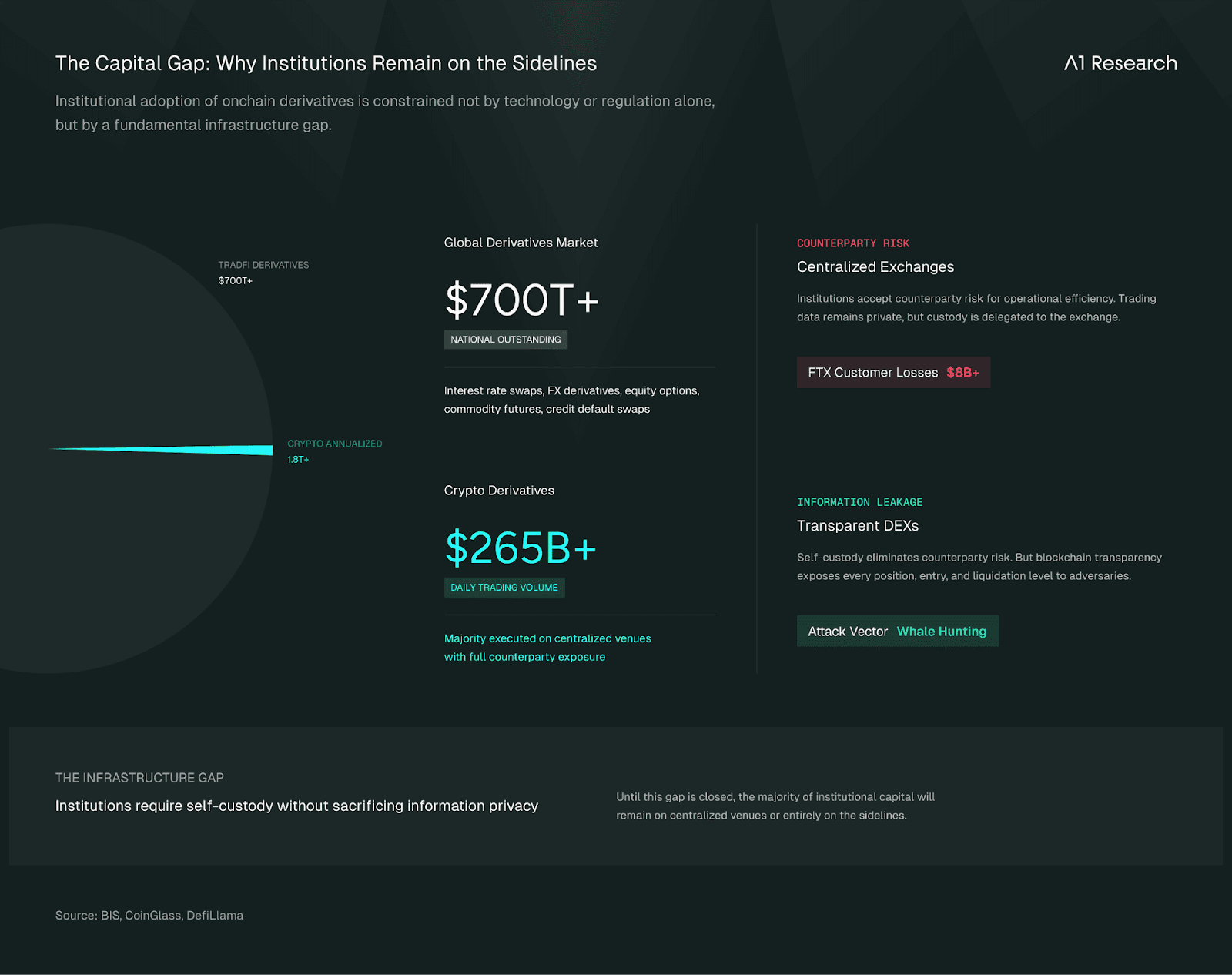

The global derivatives market represents over $700 trillion in notional outstanding value. Meanwhile, crypto derivatives process approximately $265 billion in daily volume, but the vast majority occurs on centralized venues. Institutional allocation to crypto assets is growing but remains constrained by infrastructure gaps, with privacy being among the most critical.

The FTX collapse crystallized the counterparty risk inherent in centralized exchanges. It’s why institutions want (or need) self-custody. They have seen what happens when largely unregulated exchange operators have unchecked control over customer funds. But they do not want self-custody at the cost of information leakage that degrades their trading edge and exposes them to predatory behavior. This creates a paradox: the very transparency that makes DeFi trustless also makes it unsuitable for sophisticated capital.

That’s why the addressable market requires realistic framing. Global asset managers control roughly $128 trillion in AUM. A 1% allocation to crypto derivatives would represent $1.2 trillion seeking execution venues.

However, regulatory constraints, risk mandates, and operational requirements mean actual near-term institutional demand is likely 1-2 orders of magnitude smaller. A more conservative estimate: if 0.1% of institutional AUM sought private onchain derivatives exposure over the next 3-5 years, that represents $120 billion in potential flow. Current onchain derivatives infrastructure (approximately $50-100 billion monthly volume across all venues) currently only captures a fraction of this.

2.3 Privacy as Infrastructure, Not Feature

Privacy is not a nice-to-have feature for retail users concerned about surveillance. It is the foundational infrastructure component required for institutional-grade markets. Just as traditional finance has dark pools, block trading desks, and confidential OTC markets, onchain equivalents must exist for blockchain-based markets to mature. Without these venues, institutional participation remains structurally limited.

Paradex represents one of the currently most promising attempts at this infrastructure layer. Rather than treating privacy as an optional feature, the platform built privacy into the architecture from inception. This allows it to address the primary threat vectors (external liquidation hunting, copy-trading without consent, MEV extraction) while maintaining self-custody.

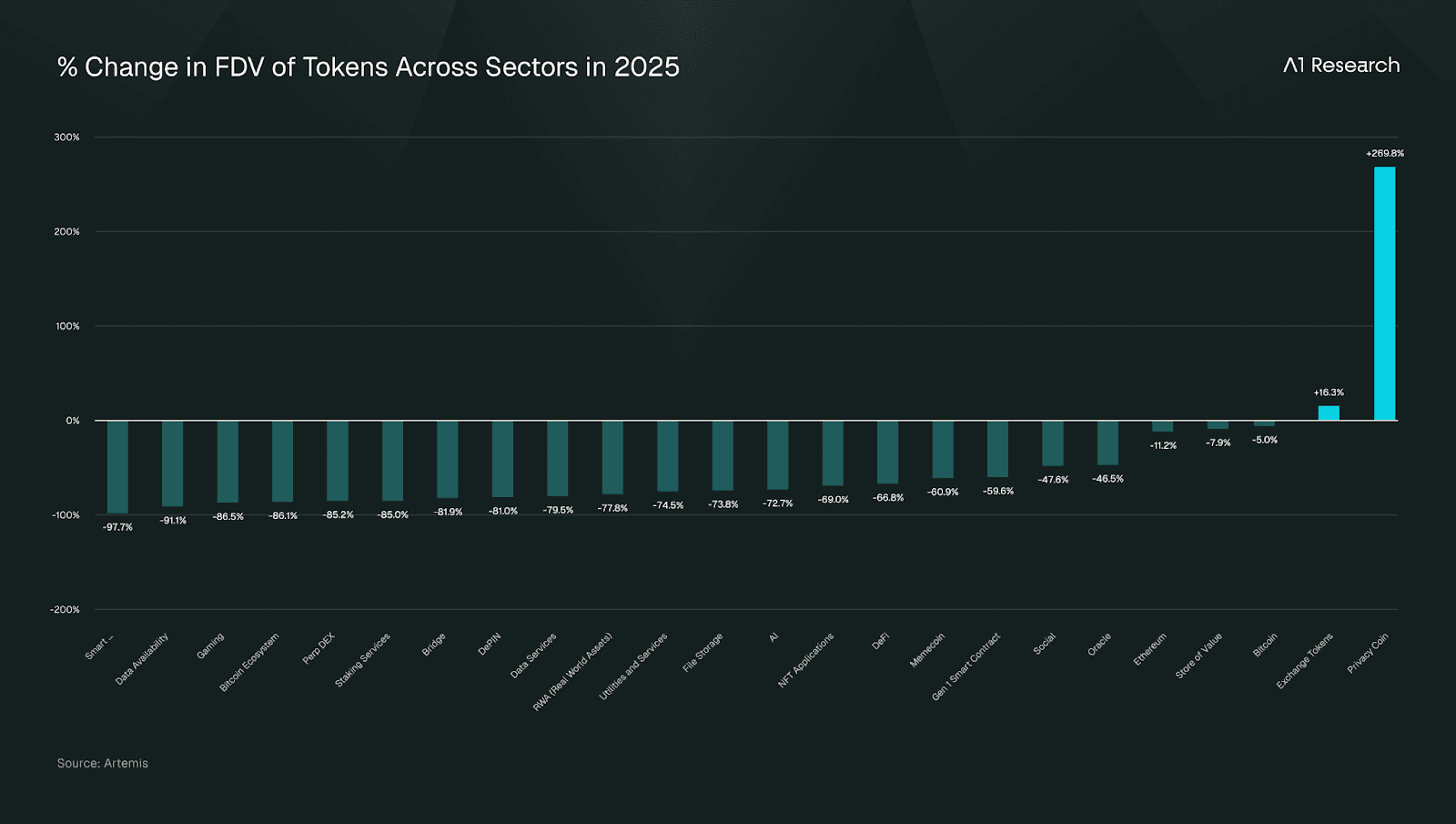

The timing for bringing this to market might be just right too. The 2025 privacy renaissance, led by Zcash's resurgence and re-emerging interest in privacy infrastructure, signals a market ready for privacy-preserving DeFi. Regulatory conversations around financial privacy seem to be maturing too, with clearer frameworks emerging for how privacy and compliance can coexist. Paradex arrives at this inflection point with production-ready infrastructure at the right time.

3. Privacy Architecture: The Core Innovation

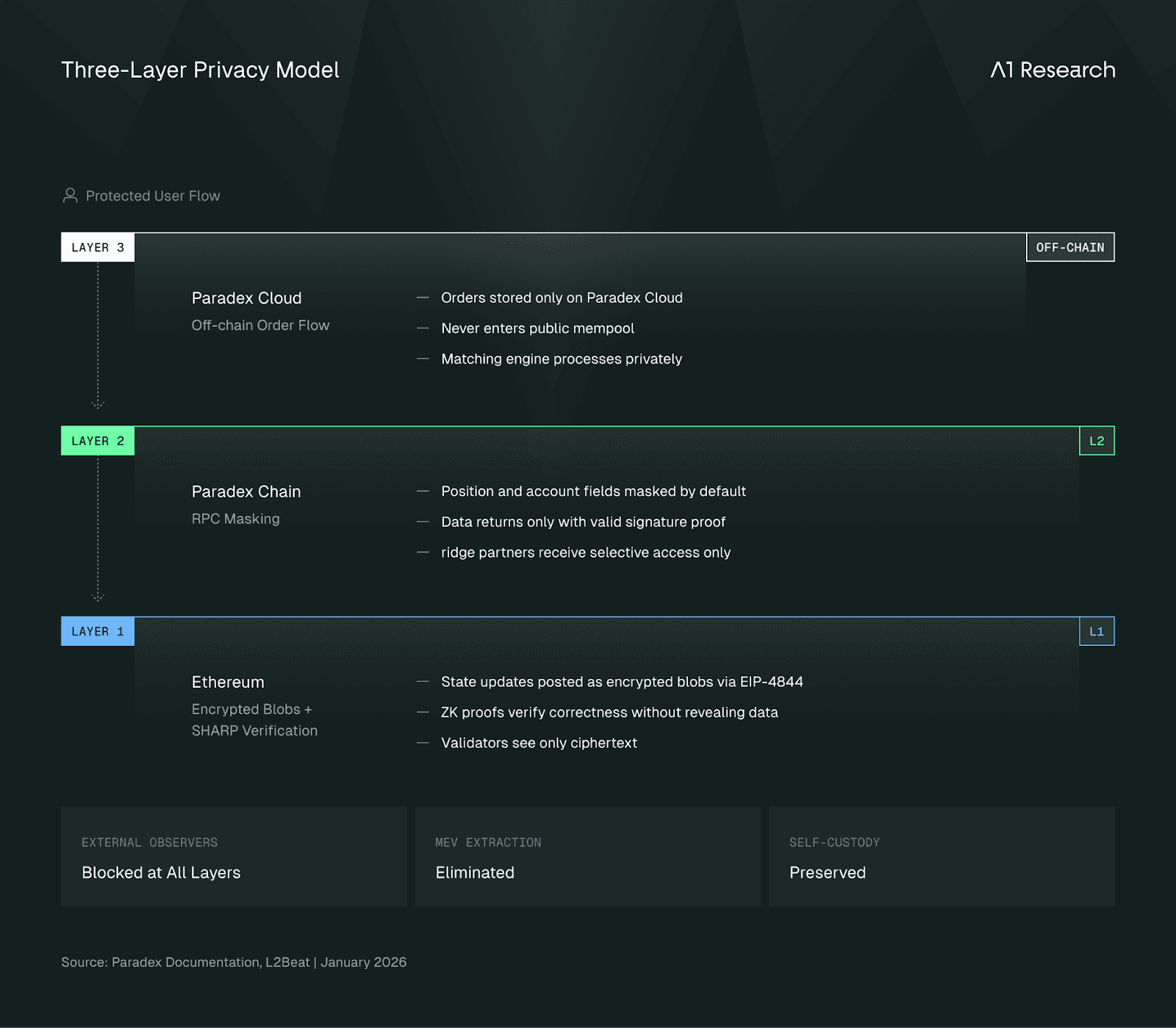

This is where Paradex's value proposition beyond RPI becomes tangible. Privacy is not a feature toggle here. It is an architectural reality spanning three distinct layers, from Ethereum L1 through to order submission. Understanding what is protected at each layer, and what trust assumptions remain, is essential.

3.1 The Three-Layer Privacy Model

Paradex implements privacy across three distinct layers, each with different security guarantees and trust assumptions.

Layer 1: Ethereum Data Availability

State updates post as encrypted blobs via EIP-4844, and ZK proofs verify state transition correctness without revealing underlying data. This encryption path is unique to Paradex Chain and not part of public Starknet defaults.

Encryption Mechanics:

The scheme employs hybrid symmetric/asymmetric cryptography native to the Starknet ecosystem:

For each state update, a random symmetric key

k(a felt252) is generatedThe symmetric key is encrypted to each Privacy Council member's public key using Stark curve cryptography:

For each council member

iwith public keyPubᵢ, a random variablerᵢis selectedThe key is encrypted using

(Rᵢ = G*rᵢ, Yᵢ = blake(Pubᵢ*rᵢ) + k)whereGis the curve generator

The blob payload is encrypted using

blake(i, k) + pᵢ, wherepᵢis theith element

SHARP Integration:

The sequencer's aggregator determines which blocks are included in each state update, combines the squashed state differences, serializes into the blob payload, and forwards the commitment so that SHARP (Shared Prover) and Ethereum can enforce that the published diff matches the proven state transition. The ZK proof validates both state transition correctness and encryption commitment correctness.

Consequently, Ethereum validators and L1 observers see only ciphertext, while the aggregated state diff that would normally enable full state reconstruction remains opaque.

Layer 2: Paradex Chain (RPC Masking)

Privacy on Paradex Chain is guaranteed through custom RPC configuration:

RPC nodes mask position and account fields by default

Data returns only after proving account ownership via valid signature

Bridge partners receive only selective access to transaction data required for deposits/withdrawals; account state remains private

This prevents third-party position tracking, liquidation hunting bots, and copy-trading without consent.

Layer 3: Off-chain Order Flow (Paradex Cloud)

The Central Limit Order Book (CLOB) operates entirely off-chain within Paradex Cloud:

Orders are stored only on Paradex Cloud and known only to operators

Orders never enter a public mempool, eliminating front-running at the order submission level

The matching engine processes orders without broadcast to external parties

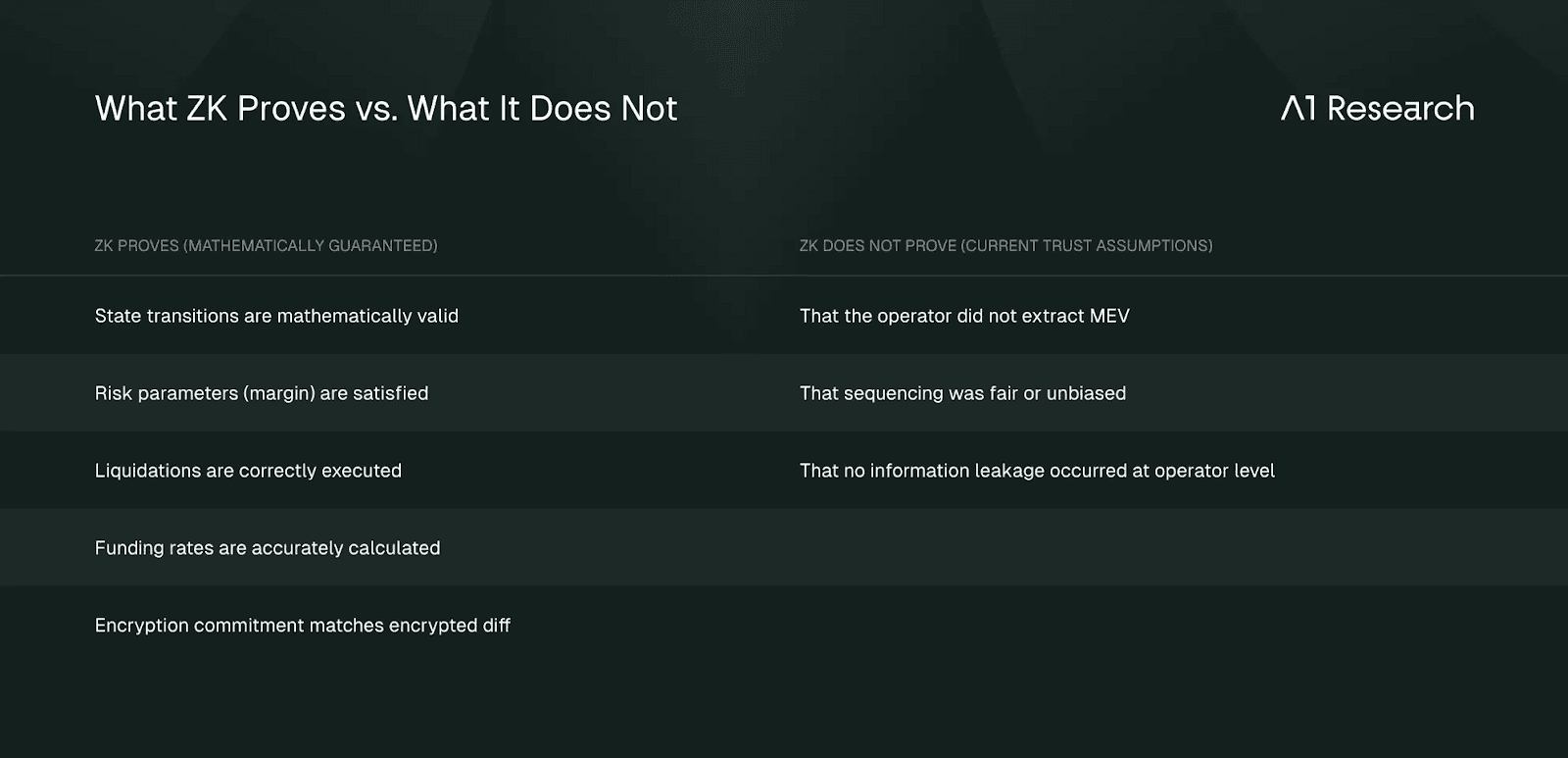

What ZK Proves vs. What It Does Not

These limitations represent the trust assumptions users currently accept. The key distinction however is that Paradex's architecture protects against the primary external threat vectors (liquidation hunting, copy-trading, MEV extraction) while operator trust assumptions mirror those of any traditional exchange, with the critical difference that Paradex never takes custody of user funds.

3.2 Understanding Privacy Scope and Limitations

What Privacy Protects Against

Privacy protects against external observers, the primary threat vector for institutional participants:

Other traders viewing positions

Blockchain indexers and explorers reconstructing state

MEV searchers and front-running bots

Liquidation hunters targeting exposed positions ("so you can't get hunted")

Copy-traders replicating strategies without consent

The Operator Trust Assumption

The current limitation is important to understand: Paradex's centralized sequencer has full visibility into order flow during matching. While users are protected from external predatory behavior, the operator theoretically retains the ability to:

View pending orders before execution

Observe liquidation levels across accounts

Identify position accumulation patterns

This represents operator-trust privacy rather than trustless cryptographic privacy.

Institutional Framing

Users trust the operator with order flow visibility, as they would any exchange. The distinction matters: Paradex's privacy protects against the primary external threat vectors while the operator trust assumption is mitigated by:

Reputational incentives (Paradigm's institutional backing)

No custody of user funds (self-custodial architecture)

Verifiable on-chain settlement via STARK proofs

For institutional risk assessments, this is more comparable to trusting a prime broker or exchange with position data, with the critical difference that Paradex never takes custody (which is key).

3.3 Privacy Council Structure

The Privacy Council comprises three members: Paradex (operator), Paradex Foundation (governance entity), and Karnot (independent third party, Starknet infrastructure provider). A 1-of-3 threshold enables emergency key disclosure, meaning any single council member can recover the symmetric key through k = Yᵢ - Rᵢ * Privᵢ and decrypt the state data.

This mechanism preserves the possibility of an escape hatch: if Paradex becomes inoperable, the council can decrypt and publish necessary state to enable user fund recovery.

The risk disclosure is important to understand. As L2Beat explicitly notes: "Users are not able to independently reconstruct the L2 state without relying on the council members" and "Funds can be frozen if no privacy council member discloses the decryption keys."

Practically, users cannot verify L2 state or force withdrawals if the operator goes down without council cooperation. The 3-member council with 1-of-3 threshold provides redundancy, but this remains a trust assumption rather than a trustless guarantee. Council expansion to additional independent members is planned as Paradex scales, though no specific timeline has been announced.

4. Technical Architecture and Product Design

Understanding why Paradex can deliver institutional-grade privacy requires understanding how it is built. The architecture is not an accident, every design choice reflects a deliberate trade-off between performance, privacy, and trust minimization.

4.1 The Appchain Model

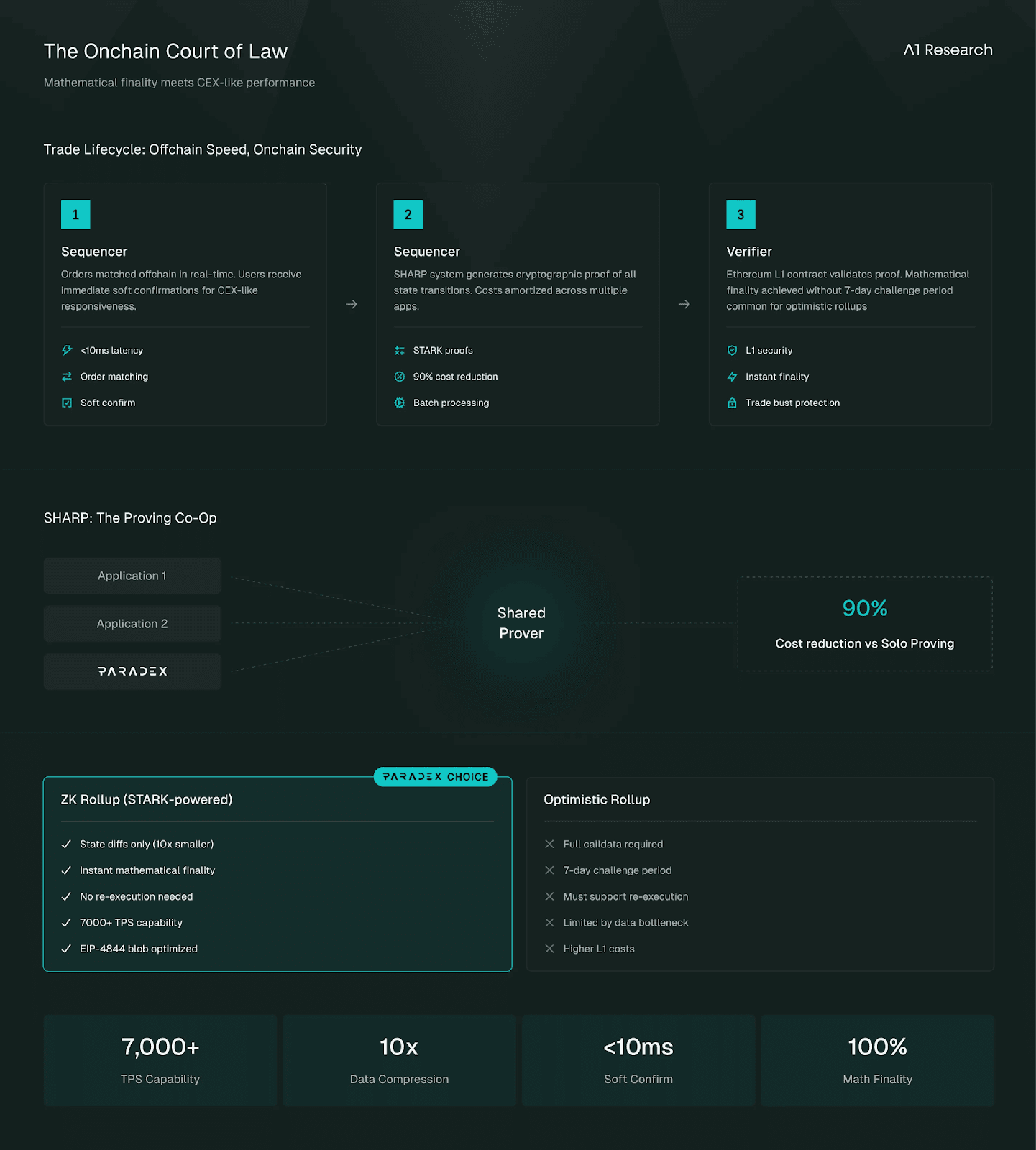

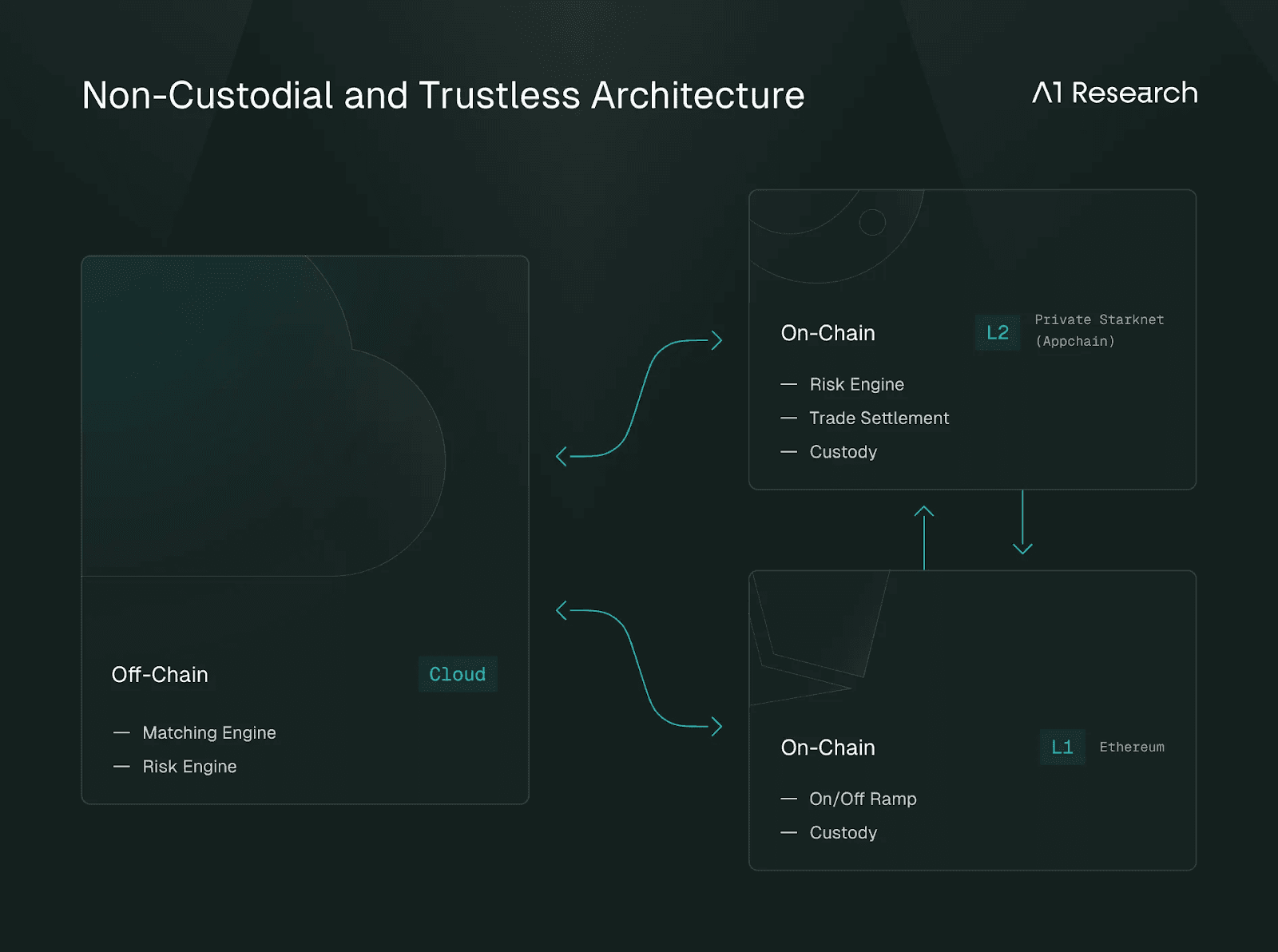

Paradex operates as an L2 appchain settling directly to Ethereum. It runs a private instance of the Starknet technology stack, utilizing the SN Stack components: CairoVM for computation, the Stwo prover (upgraded across the ecosystem in November 2025) for proof generation, and SHARP infrastructure for shared proving.

The appchain model offers several advantages over deployment on a shared rollup. Dedicated block space eliminates congestion from unrelated activity; Paradex does not compete with NFT mints or token launches for throughput. Custom transaction types can be optimized specifically for derivatives trading, enabling specialization impossible on general-purpose chains. Full control over the sequencing and execution environment allows fine-tuning for trading workloads. Most critically, the privacy features Paradex implements would be impossible on a transparent execution layer with shared state.

The current centralization trade-offs require context. A single operator EOA proposes all blocks, which is standard for early-stage appchain development, and smart contract upgrades are controlled by a 2/5 multisig without a time delay (a risk L2BEAT flags). These are real limitations, but they should be weighed against the competitive landscape: many perp DEX competitors run fully off-chain systems with merely deposit contracts on-chain, which is arguably far less decentralized. The SHARP verifier maintains an 8-day upgrade delay providing ecosystem-level protection, and progressive decentralization remains on the roadmap.

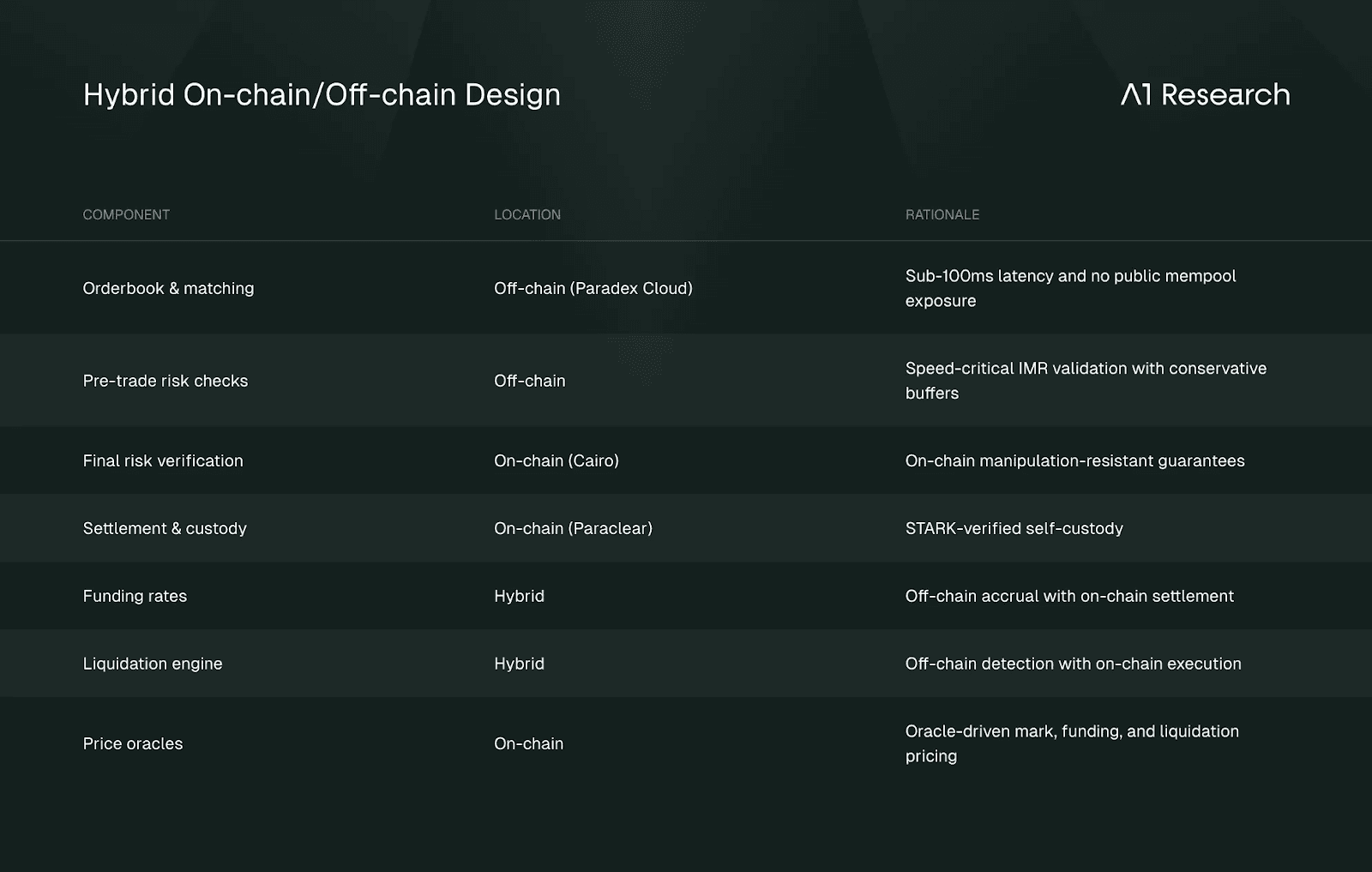

4.2 Hybrid On-chain/Off-chain Design

Paradex implements a thoughtful distribution of components between on-chain and off-chain environments, optimizing for both performance and trust guarantees. The design philosophy places speed-critical operations off-chain for CEX-competitive user experience while keeping trust-critical operations on-chain for verifiable guarantees.

The privacy layer spans both environments: data is encrypted at rest on-chain and access-controlled off-chain, ensuring position confidentiality throughout the trading lifecycle.

4.3 Cairo and the Stwo Prover

Cairo is a purpose-built language for provable computation, enabling complex risk calculations with cryptographic verification. Portfolio margin math executes in CairoVM with proof generation, ensuring that risk parameters are mathematically verified rather than simply asserted. This is possible because Cairo is substantially more expressive than the EVM (and Solidity) for financial application logic, allowing Paradex to implement sophisticated risk models that would be prohibitively expensive or impossible on Ethereum mainnet (and many other EVM chains).

The Stwo prover upgrade in November 2025 (mainnet November 5) replaced the Stone prover across the Starknet ecosystem. Paradex integrated the Grinta architecture upgrade in November 2025, bringing sub-second pre-confirmations (~500ms, down from ~2s) to its appchain. Implementing Circle STARKs with significant proving efficiency improvements, Stwo enables faster proof generation and higher throughput. The reduced operational costs benefit Paradex infrastructure while maintaining the same cryptographic security guarantees.

4.4 Paradex's Unique Market Microstructure Design & Institutional Trading Features

Building on the privacy architecture described earlier in this report, Paradex differentiates through market microstructure innovations adapted from traditional finance. These features collectively create an institutional-grade trading environment unavailable elsewhere in DeFi.

Universal Portfolio Margin

Traditional DeFi forces traders to over-collateralize every position independently, a capital-inefficient relic of early smart contract limitations. Paradex is eliminating this friction with portfolio margin capabilities targeting 80-90% reduction in margin requirements for hedged positions. The CairoVM-powered risk engine performs real-time portfolio-level risk assessment, recognizing natural hedges rather than calculating margin position-by-position.

Practical example: A basis trade (long BTC spot, short BTC perpetual) requires significantly less margin than the sum of individual position requirements because the risk engine recognizes the offsetting exposure. Cross-margining operates across all positions in a single account, with risk calculations cryptographically verified in Cairo. Note that is currently in invite only beta though..

Request for Quote (RFQ) System

Paradex is integrating an intent-based RFQ protocol in cooperation with Paradigm, the institutional crypto liquidity network processing approximately $1.2 billion in daily options volume. Once live, this will provide access to Paradigm's institutional market maker network for private block trade execution, meaning large orders receiving firm quotes without market impact, with atomic multi-leg execution for complex strategies.

Zero-Fee Model

While competitors extract 2.5-4.5 basis points per trade, Paradex operates with 0% maker fees and 0% taker fees, a structural disruption comparable to Robinhood's elimination of brokerage commissions. Revenue derives from a PFOF-style model: market makers pay for the right to access curated retail flow (0.5 bps on RPI fills), plus spread capture and liquidation fees.

This model is sustainable through institutional flow and network effects. Zero fees attract market makers who improve liquidity, creating a flywheel where better liquidity attracts more traders, generating more valuable flow for makers.

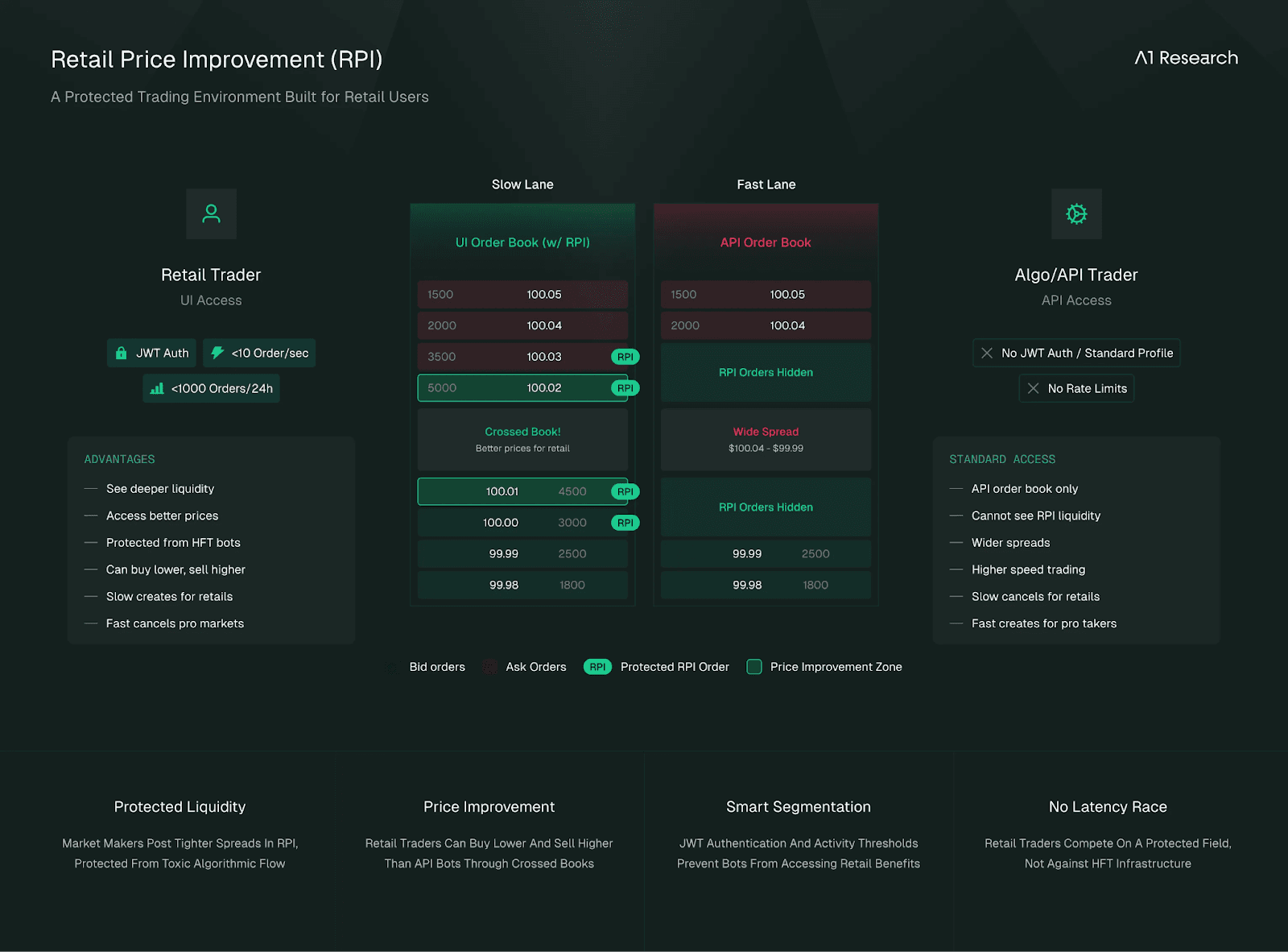

Retail Price Improvement (RPI)

RPI implements a dual orderbook architecture separating retail from algorithmic flow, Paradex's most innovative market structure feature.

The RPI Book contains hidden liquidity visible only to UI traders, completely inaccessible via API. This eliminates the information advantage enabling toxic flow: front-running, sandwich attacks, and adverse selection. Market makers can post tighter spreads with larger size knowing their quotes won't be picked off by faster participants.

A JWT-based (JSON Web Token) Trader Profile system enforces classification through behavioral throttling. Speed bumps of 500ms for order submission and 300ms for cancellation make high-frequency trading mechanically impossible for retail users. Strict rate limits (3 orders/second, 1,000/24 hours for retail versus 800/second for Pro/API) create clear separation. Exceeding limits triggers automatic downgrade, losing RPI access.

Unlike TradFi PFOF where order flow is routed to specific market makers though, all makers on Paradex compete openly for retail flow, which means best price/size wins and there are no routing conflicts. The model's competitive relevance got early validation when Binance launched a similar mechanism in November 2025.

For deeper analysis of Paradex’s CLOB infrastructure and product offering, also check our previous research piece from the “CLOB Season” Campaign in October/November: The Zero-Fee SuperExchange for the Internet Economy.

5. Competitive Landscape and Positioning

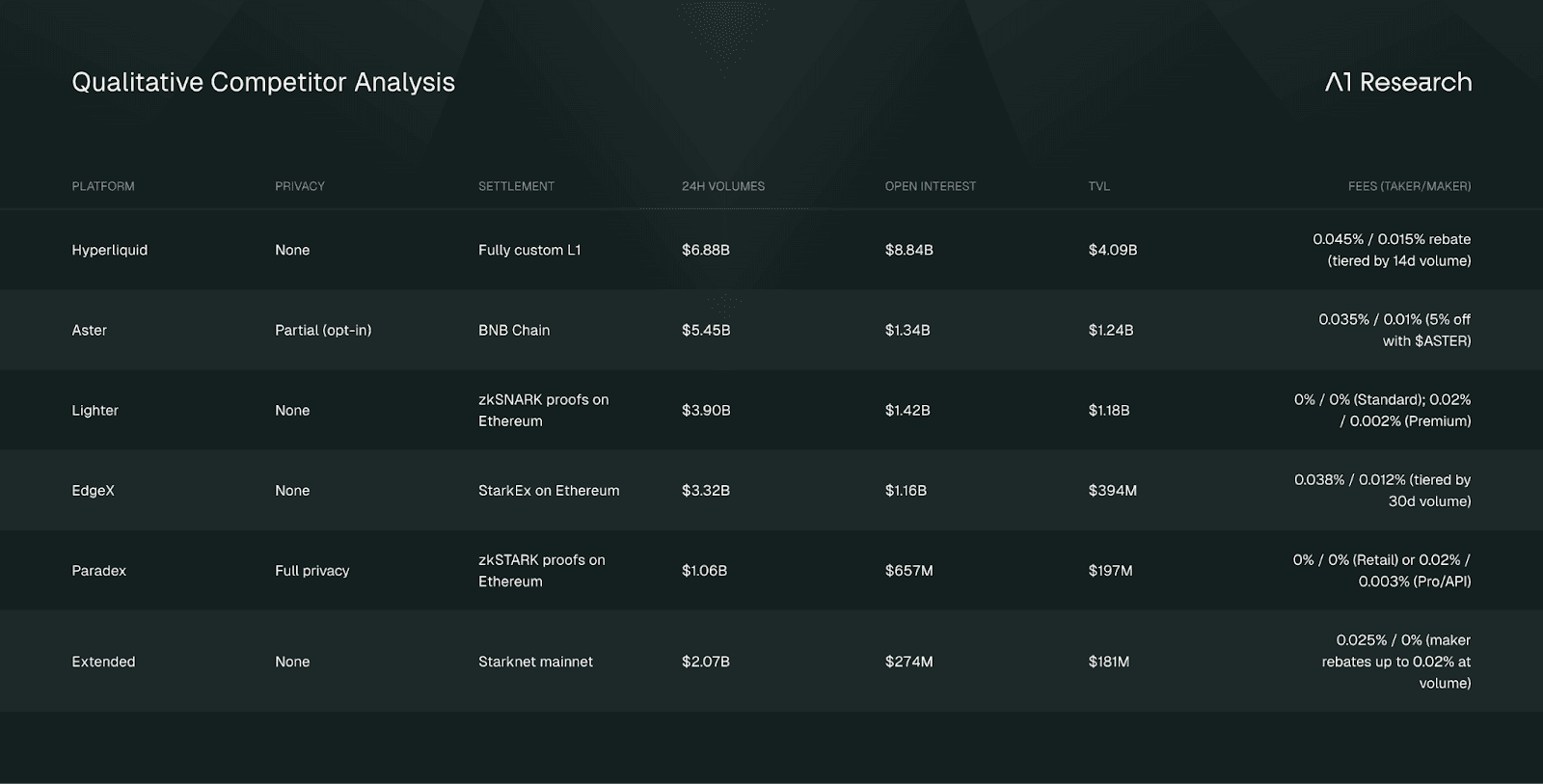

The perp DEX market is fragmenting rapidly. Hyperliquid dominates volume, but volume alone does not determine which infrastructure captures institutional flow. Paradex's 4x volume growth over six months (July-December 2025) suggests the market is already responding to the privacy value proposition. This section examines where Paradex fits in the competitive landscape, qualitatively by feature set, and quantitatively by execution quality.

5.1 Qualitative Competitor Analysis

The following comparison uses data from CoinGlass as of January 13, 2026. Note: Volume and fee figures may vary slightly between data providers (CoinGlass, DefiLlama) due to methodology differences and timing. Section 5.2 uses DefiLlama data for execution quality analysis.

Source: CoinGlass, January 13, 2026. Fee structures verified from official documentation; see Section 5.2 for detailed fee analysis.

Paradex ranks sixth by 24-hour volume among decentralized derivatives exchanges (DefiLlama, January 2026), processing approximately $1.26 billion daily. This represents roughly 15% of market leader Hyperliquid's volume. The gap reflects different positioning: Hyperliquid optimizes for throughput and transparent markets; Paradex optimizes for privacy and execution quality.

Notable observations from the data:

Capital efficiency. Paradex demonstrates strong capital efficiency with an Open Interest to TVL ratio of 3.3x ($657M OI on $197M TVL), compared to Hyperliquid's 2.2x. This suggests effective capital utilization despite smaller absolute size.

Fee structure differentiation. Only two platforms in the top tier operate with zero fees: Paradex and Lighter. Both settle to Ethereum via ZK proofs. Lighter offers verifiable matching but no position privacy, making it a potential competitor to monitor. It currently still has higher volume ($3.9B vs $1.06B), but Paradex has been catching up, and has a strong differentiator on its side (privacy).

Market breadth. Paradex offers 110 trading pairs, competitive with larger platforms. Hyperliquid leads with 224 pairs; Aster offers 221. The gap is meaningful but not prohibitive for most institutional use cases focused on major assets.

Paradex leads on Privacy: Paradex remains the only perp DEX offering comprehensive privacy at scale through before-mentioned encrypted positions on L1, RPC-masked account data on L2, and off-chain order flow). Competitors have begun responding (Aster's Hidden Orders), but implementations remain partial or in development. For traders requiring position confidentiality, Paradex is currently the only production option.

Volume trajectory is healthy too. While Paradex's $1.06B daily volume trails Hyperliquid's $6.88B, growth rates matter more than absolute size for early-stage infrastructure. Paradex monthly volume grew approximately 4x from July to December 2025 ($8B to $32B), outpacing the broader perp DEX market growth rate. If this trajectory continues, the volume gap narrows meaningfully over 12-24 months.

5.2 Quantitative Execution Quality Analysis

Overview

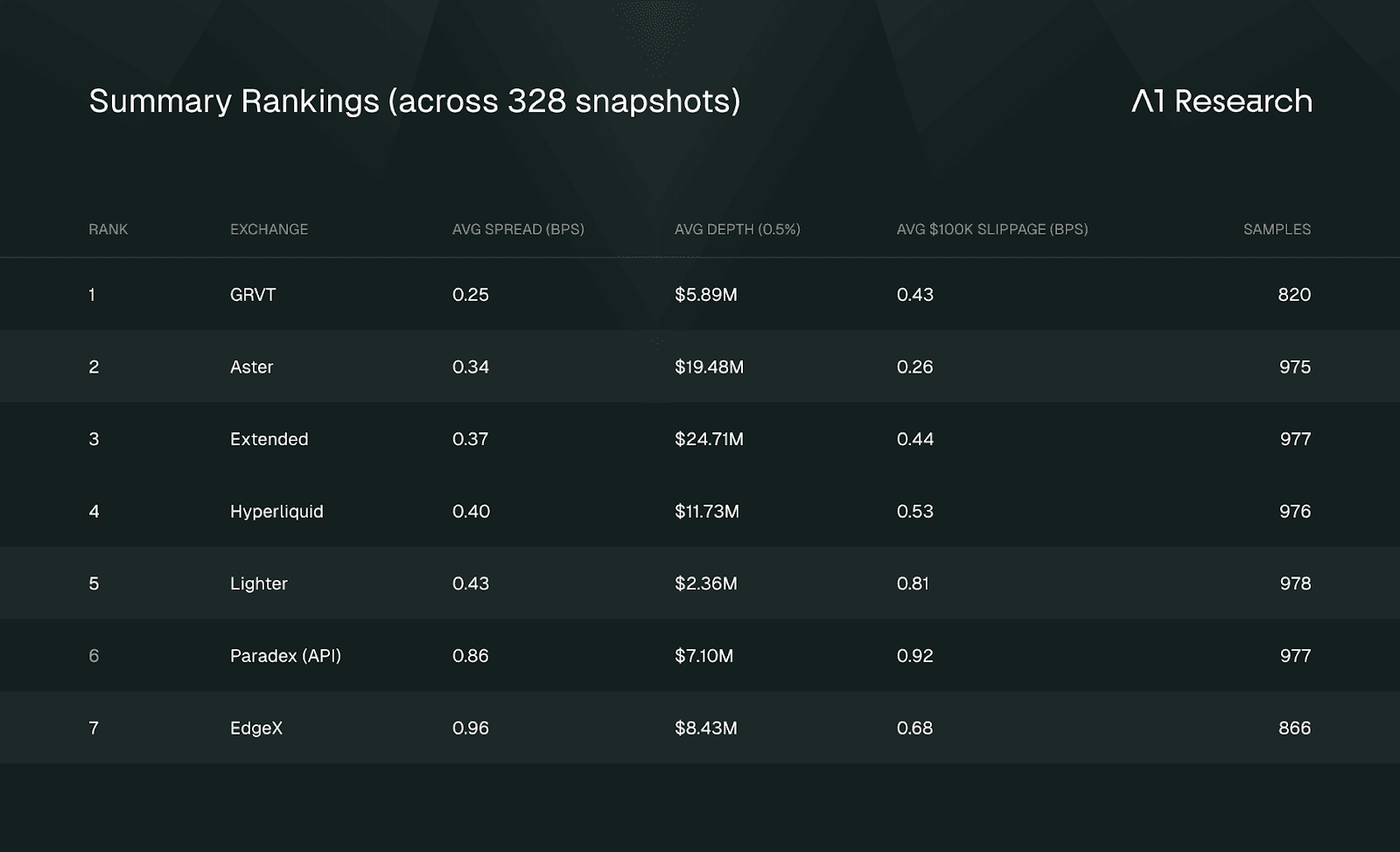

To assess execution quality across the emerging perp DEX landscape, A1 Research conducted statistical orderbook analysis of seven leading platforms: Paradex, Hyperliquid, Aster, Lighter, Extended, EdgeX, and GRVT. Data was collected via public REST APIs across 328 independent snapshots over approximately three days (January 13-16, 2026), providing robust statistical validity across varying market conditions.

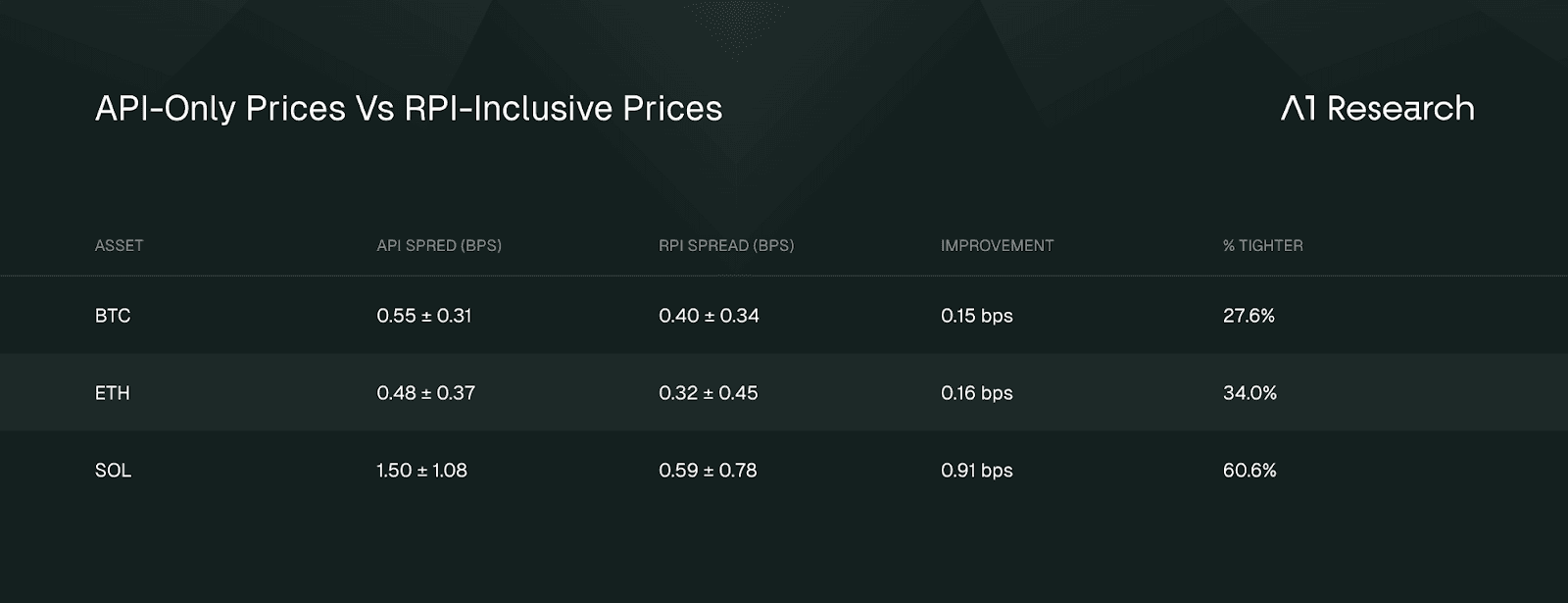

Additionally, we conducted a separate analysis of Paradex's Retail Price Improvement (RPI) system, collecting 350 snapshots over three hours to quantify the execution advantage available to retail UI traders versus API traders.

Market Context: Perp DEX Volume Rankings

Before examining execution quality, it is useful to contextualize each platform's market position. The following data from DefiLlama (January 13, 2026) shows volume metrics and open interest for the exchanges analyzed, ranked by open interest:

Source: DefiLlama Derivatives Rankings, January 13, 2026. Rankings by open interest.

Volume directly influences execution quality. Higher volume attracts more market maker competition, which compresses spreads. The spread differentials observed in this analysis correlate with these volume rankings. Notably, Paradex ranks 6th by open interest ($751M) despite ranking lower by 24-hour volume, indicating strong position retention relative to daily turnover. The 30-day volume of $35.04B demonstrates consistent activity rather than single-day spikes.

Methodology

Metrics:

Spread: ((best_ask - best_bid) / mid_price) × 10,000 (basis points)

Depth: Total USD value of orders within 0.5% of mid-price

Slippage: Volume-weighted average execution price vs. mid-price for simulated $100K order

Statistical Approach: Mean, standard deviation, median, and P95 calculated across all 328 snapshots.

Assets: BTC, ETH, SOL perpetuals

Note on Paradex Data: The main cross-exchange analysis uses Paradex's standard API orderbook endpoint for methodological consistency with other exchanges. However, Paradex operates a dual orderbook system where retail UI traders access additional RPI (Retail Price Improvement) liquidity not visible to API traders. We address this distinction separately below.

Raw Orderbook Metrics

Best Performers by Category:

Tightest Spreads: GRVT (0.25 bps avg)

Deepest Liquidity: Extended ($24.71M avg)

Lowest Slippage: Aster (0.26 bps avg)

Paradex RPI: What Retail UI Traders Actually See

The rankings above use API orderbook data for cross-exchange consistency. However, this methodology understates Paradex's execution quality for retail users. Paradex operates a dual orderbook architecture:

API Orderbook: Accessible to programmatic traders, bots, and market makers. This is what other exchanges' APIs also expose.

RPI (Interactive) Orderbook: Includes additional liquidity from market makers specifically posting for retail flow. Visible only to UI traders, completely hidden from API access.

To quantify this difference, we collected 350 snapshots from Paradex's /orderbook/{market}/interactive endpoint over three hours (January 16, 2026), comparing API-only prices versus RPI-inclusive prices:

RPI data: 350 snapshots at 30-second intervals (January 16th 2026).

The improvement is substantial: retail UI traders receive spreads 28-61% tighter than API traders on the same platform. SOL shows the largest improvement, with RPI spreads less than half the API spread.

Why RPI Matters

The RPI system creates a structural advantage for retail traders:

Protected Order Flow: RPI orders are invisible to API traders, eliminating information leakage that enables front-running and adverse selection.

Market Maker Incentives: Because market makers know RPI flow is non-toxic (human traders, not bots), they can quote tighter spreads with larger size without fear of being picked off by faster participants.

Execution Priority: Retail orders matching against RPI liquidity execute at better prices than would be available on the API book alone.

For retail users trading via the Paradex UI, the relevant comparison is RPI spreads (0.40-0.59 bps on majors), not API spreads. This positions Paradex competitively with the tightest-spread venues in the analysis, while also offering zero fees.

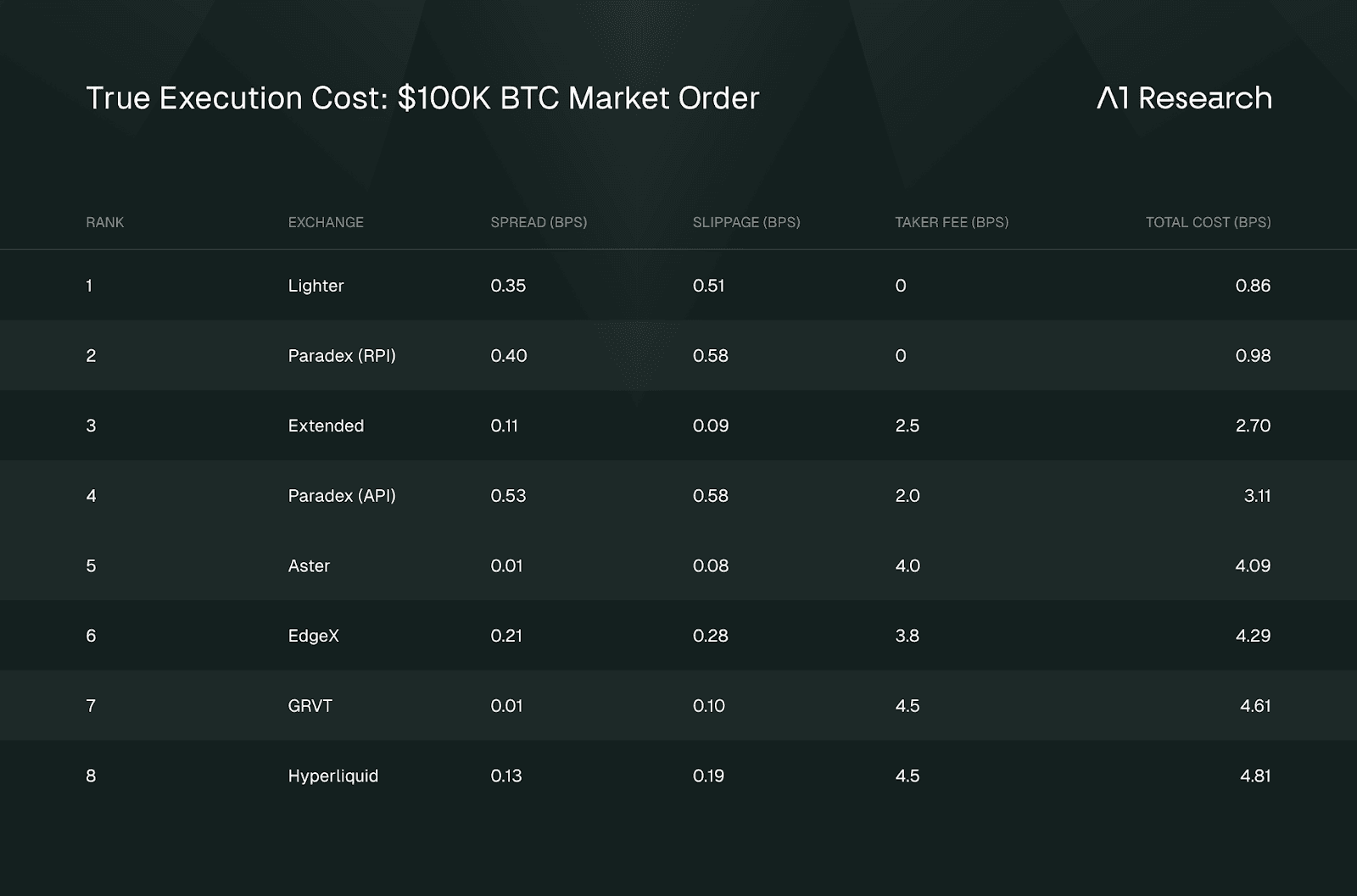

Critical Context: Fee-Adjusted Analysis

Raw orderbook metrics tell an incomplete story. Total execution cost = spread + slippage + trading fees. Several exchanges in this comparison operate zero-fee models, while others charge taker fees ranging from 2.5 to 4.5 basis points.

Fee Structure by Exchange (Verified from Official Documentation)

Fee Verification Notes:

All fee structures were verified using the official docs in January 2026.

Hyperliquid, EdgeX, and GRVT operate tiered fee structures. Hence rates shown are default/entry-level taker fees. High-volume traders qualify for reduced rates.

Paradex charges 0 bps for retail UI traders while API traders pay 2 bps taker fee.

Extended offers maker rebates (0.2-1.3 bps) for market makers exceeding volume thresholds (≥0.5% of 30-day maker volume).

This analysis uses default taker fees for consistency across platforms.

True Execution Cost: $100K BTC Market Order

The following table shows fee-adjusted execution costs using BTC-specific data. For Paradex, we include both API and RPI scenarios to illustrate the retail UI advantage:

The key finding: when fees are included, the ranking shifts materially. Paradex moves from 6th (raw API spreads) to 2nd-3rd (fee-adjusted), while exchanges with sub-basis-point spreads but higher fees become more expensive execution venues on a total cost basis. For retail UI traders accessing RPI liquidity, Paradex approaches Lighter's cost efficiency while offering privacy features Lighter lacks.

Understanding Paradex's Market Microstructure

Paradex's dual orderbook design is central to understanding its execution metrics:

Zero-Fee Model: The spread represents the complete cost for retail users. Competitors show tighter spreads but add fees that can exceed Paradex's wider spread.

RPI Mechanics: Market makers post RPI-flagged orders visible only in the UI. These orders have lowest execution priority (fill after non-RPI orders at same price) and are post-only (provide liquidity only). The crossed book appearance in the UI reflects RPI orders that won't match against API orders.

Revenue Model: Instead of charging retail traders, Paradex monetizes by charging market makers 0.5 bps for access to clean retail flow. This inverts the traditional exchange model where retail pays fees that fund market maker rebates.

No Maker Rebates: Exchanges offering sub-basis-point spreads typically fund aggressive market maker quoting through maker rebates paid from taker fees. Paradex's zero-fee model does not support rebates, resulting in naturally wider API spreads but transparent total cost.

Open Interest Ratio: Paradex's open interest ($751M) places it competitively among higher-volume platforms. The OI-to-daily-volume ratio (0.60x) exceeds Aster (0.48x), Extended (0.14x), and GRVT (0.25x), indicating traders maintain positions longer rather than churning for volume incentives.

Overall Key Takeaways

Raw spreads do not reflect total execution cost. Fee-adjusted analysis is essential for accurate venue comparison. Zero-fee models (Paradex, Lighter) rank significantly higher when trading fees are included.

Paradex RPI provides 28-61% spread improvement for retail UI traders compared to API-only access. This is a structural advantage unique to Paradex's market microstructure design.

Volume correlates with spread tightness. Hyperliquid ($7.07B daily) and Aster ($5.76B daily) lead volume rankings and demonstrate correspondingly tight spreads. This relationship is structural: higher volume attracts market maker competition.

Depth varies substantially by asset. Extended dominates BTC depth ($40.08M average). Aster leads ETH ($29.05M) and SOL ($12.65M). Traders should route based on asset-specific liquidity profiles.

Spread stability varies across venues. Aster and Extended show low variability (σ < 0.06 bps on majors). Paradex shows higher variability (σ = 0.39-0.91 bps), consistent with the RPI orderbook segmentation design where UI and API books can diverge.

Institutional users should calculate total cost for their specific volume tier and use case. Fee structures are tiered; high-volume traders may achieve meaningfully different economics than shown here.

Methodology Note: Cross-exchange execution quality metrics represent statistical averages across 328 snapshots collected over approximately three days (January 13-16, 2026). Paradex RPI analysis based on 350 snapshots collected over three hours (January 16, 2026) from the /orderbook/{market}/interactive endpoint. Spreads, depth, and slippage fluctuate with market conditions, time of day, and volatility regimes. EdgeX and GRVT returned fewer samples (866 and 820 respectively vs ~977 for others) due to intermittent API availability. Market volume and OI data sourced from DefiLlama (January 2026).

5.3 The Data Narrative: Capital Follows Value

The quantitative analysis reveals a clear trend: the market is migrating toward total execution value, not raw spread metrics.

The Fee-Adjusted Reality: When trading fees are included, Paradex moves from 6th place (raw API spreads) to 2nd-3rd place (fee-adjusted total cost). For retail UI traders accessing RPI liquidity, Paradex ranks 2nd overall at 0.98 bps total cost, within striking distance of market leader Lighter (0.86 bps) while offering privacy features Lighter lacks. For professional traders managing basis points, "sticker price" spreads are a distraction. Paradex's zero-fee model delivers a structural cost advantage that compounds with every trade.

The RPI Advantage: Our dedicated RPI analysis quantifies what retail traders actually experience: 28-61% tighter spreads compared to API-only access. On SOL, RPI spreads (0.59 bps) are less than half the API spread (1.50 bps). This is not marketing, it is measured execution improvement from 350 independent snapshots. The dual orderbook architecture creates a venue where retail traders receive institutional-quality execution without paying institutional fees.

Compounding Momentum: Monthly volume growth from $8B (July 2025) to $32B (December 2025) represents 4x expansion in six months, approximately 25% month-over-month compounding. This is not incremental growth; it is capital migration to venues that protect information.

Capital Efficiency Leadership: With an OI-to-TVL ratio of 3.3x versus Hyperliquid's 2.2x, Paradex is not merely growing, it is utilizing capital more efficiently than the market leader. The 0.60x OI-to-daily-volume ratio (versus Aster's 0.48x and Extended's 0.14x) indicates traders are holding positions rather than churning for incentives.

The Verdict: The data confirms Paradex has long transcended "niche privacy play" status. It is a high-growth liquidity hub capturing flow from transparent venues by delivering mathematically superior total execution cost. Privacy is the moat; execution quality is the product.

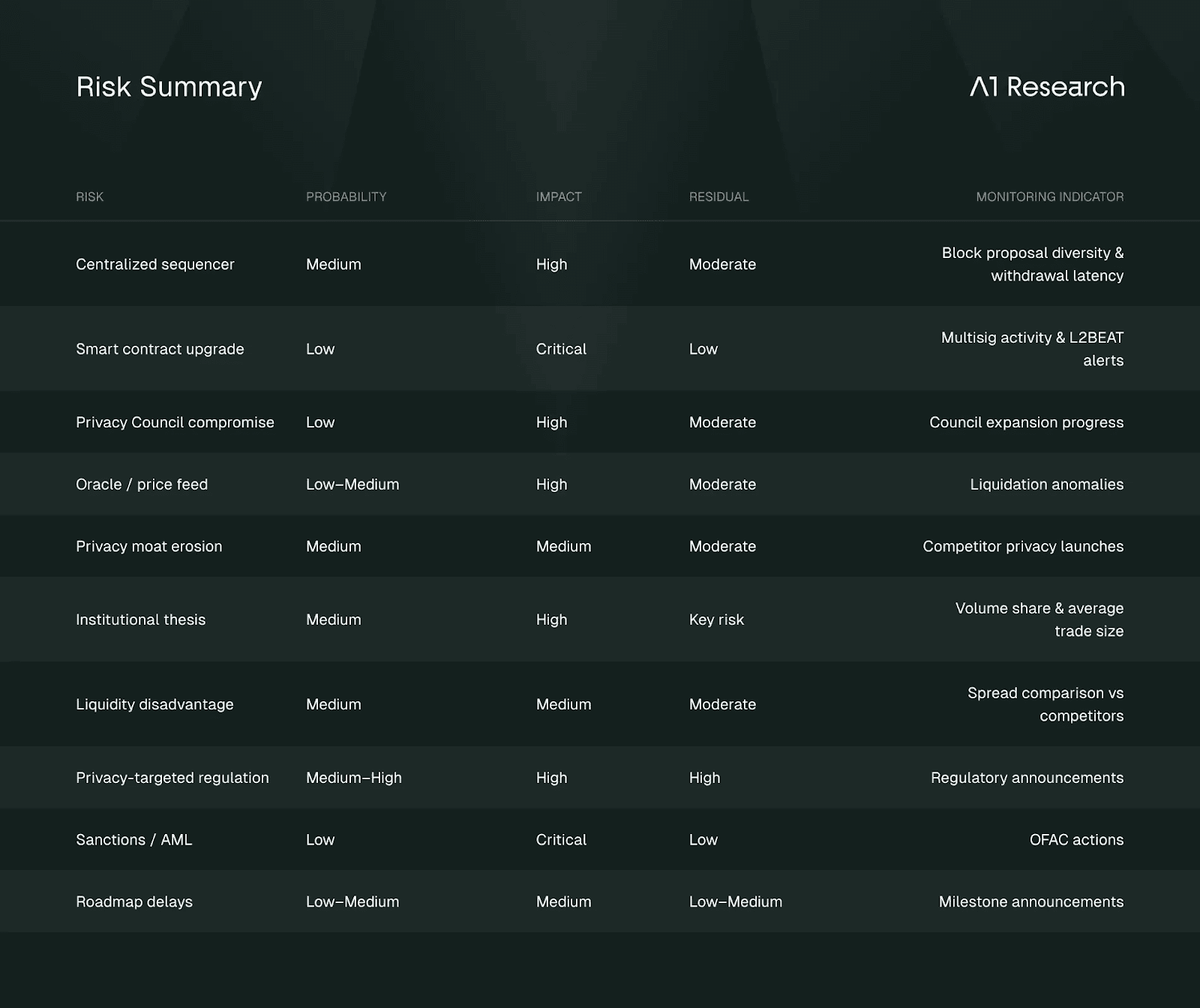

6. Risks & Mitigations Assessment

No comprehensive analysis is complete without honest risk assessment. Paradex's privacy-first architecture introduces unique risk vectors alongside standard DeFi concerns. The following framework assesses risks over a 12-24 month horizon.

Technical and operational risks center on centralization. A single operator EOA proposes all blocks, with failure modes including downtime, key compromise, or malicious behavior. STARK proofs ensure state validity regardless of operator behavior, and Ethereum settlement provides ultimate recourse, but residual risk remains moderate.

Smart contract upgrades present the most severe technical risk vector though, as a 2/5 multisig controls upgrades without time delay, which L2BEAT flags as critical. The SHARP verifier's 8-day upgrade delay at ecosystem level provides some protection, but residual risk is low but non-zero.

Privacy Council key compromise is another consideration to be made: three entities hold decryption keys with a 1-of-3 threshold, meaning compromise of a single key enables historical position data decryption.

Oracle and price feed risks are endemic to DeFi derivatives as well, but Paradex mitigates this with multiple price sources and outlier detection.

Market and competitive risks include privacy moat erosion as competitors implement privacy features (e.g Aster's Hidden Orders). Architectural privacy is harder to retrofit than build from inception, giving Paradex a 12+ month head start.

The institutional adoption thesis is the key strategic risk as per the case outlined in this report. If institutions accept transparency, remain on CEXs, or regulation forces transparent venues, Paradex might become a niche product rather than widely adopted infrastructure. TradFi precedent (dark pools capture ~15% of US equity volume) suggests privacy demand is structural tough. Yet, the liquidity disadvantage is (still) real: Paradex at ~$35B monthly volume vs. Hyperliquid at ~$147B means a ~4x gap, though Paradigm backing/integration and RFQ mitigate this for block trades.

Regulatory risks probably represent the most significant uncertainty. EU MiCA, FATF travel rule, and SEC enforcement actions emphasize transparency. Privacy venues could face prohibition, compliance requirements undermining the value proposition, or banking restrictions. Paradex operates offshore and is a trading venue with authenticated users (not a mixer), with regulatory clarity improving in UAE, Switzerland, Singapore and even the USA (undoubtedly the largest market). Residual risk remains high though. OFAC has sanctioned smart contracts directly in the past, and politics can be volatile. So while probability right now seems low, sanctions or AML enforcement would be existential.

Execution risks relate to roadmap delivery. Key milestones lack public timelines: full cryptographic privacy, sequencer decentralization, Privacy Council expansion. However, 2025 execution was strong (Privacy Perps, Grinta upgrade, Stwo integration, RPI launch, Karnot council addition), suggesting the team can deliver.

Overall risk profile is slightly elevated but appropriate for early-stage infrastructure with institutional backing. Technical risks are manageable with standard monitoring. Regulatory risk is the primary uncertainty and largely exogenous though, while the institutional adoption thesis remains unproven but has structural support from TradFi precedents.

7. Conclusion and Outlook

As of early 2026, the primary challenge facing decentralized finance has shifted from a question of basic scalability to one of professional viability. While high-performance rollups and L1s have proven they can handle institutional-grade volume, Paradex has addressed the more critical, often overlooked requirement: the necessity of confidentiality in competitive markets.

By successfully bridging the security of Ethereum settlement with the privacy requirements of high finance, the platform has transitioned from a technical proof-of-concept into a production-scale piece of infrastructure. This evolution is validated not just by the architecture, but by a compounding 25% month-over-month growth in volume and a daily turnover that consistently exceeds $1.2 billion.

This momentum is anchored in the substantive technical upgrades delivered throughout 2025. Various upgrades have reduced execution latency to the sub-500ms range, a threshold that effectively narrows the gap between centralized venues and Paradex as their decentralized counterpart. Furthermore, the Retail Price Improvement (RPI) system has demonstrated that a zero-fee model can be structurally sustainable when paired with sophisticated orderbook segmentation. These are not merely feature additions, they represent a fundamental redesign of market microstructure aimed at protecting "uninformed" flow and reducing the "Visibility Tax" that has historically plagued transparent onchain trading.

The strategic outlook for Paradex is defined by its targeted progression toward becoming a central hub for private onchain derivatives. The roadmap ahead, marked by the DIME token launch, the rollout of Universal Portfolio Margin, and more, suggests a platform focused on long-term capital efficiency and viability from the ground up rather than short-term retail churn.

For institutional participants and professional traders, the value proposition is becoming increasingly distinct. As the market continues to mature, the choice between broadcasting proprietary strategies to a public mempool or migrating to a privacy-preserving environment will likely define the next era of decentralized trading. Paradex has built the infrastructure for this transition, and the data suggests the migration is already underway.

Disclaimer: The content provided in this article is for educational and informational purposes only and should not be construed as financial, investment, or trading advice. Digital assets are highly volatile and involve substantial risk. Past performance is not indicative of future results. Always conduct your own research and consult with qualified financial advisors before making any investment decisions. A1 Research is not responsible for any losses incurred based on the information provided in this article. This campaign contains sponsored content. A1 Research and its affiliates may hold positions in the projects and protocols mentioned in this article.

Recommended Articles

Dive into 'Narratives' that will be important in the next year